Understanding the fluctuations in the 18 Carat Gold Price In Pakistan Per Tola requires navigating a complex landscape of global trends, local market dynamics, and economic factors. This guide delves into the intricacies of gold pricing, providing you with valuable insights to make informed decisions.

Factors Influencing the 18 Carat Gold Price in Pakistan

The price of gold, including the 18 carat variety, is influenced by a multitude of interconnected factors that create a dynamic and ever-changing market:

-

Global Gold Prices: As a globally traded commodity, gold prices in Pakistan are heavily influenced by international markets, primarily driven by supply and demand dynamics on major exchanges like the London Bullion Market Association (LBMA).

-

Currency Fluctuations: The value of the Pakistani Rupee (PKR) against the US dollar plays a crucial role. A weaker PKR makes gold imports more expensive, directly impacting local prices.

-

Local Demand and Supply: Festive seasons, weddings, and investment trends within Pakistan directly influence local demand. Similarly, domestic gold supply from mines and recycled sources impacts price fluctuations.

-

Economic Indicators: Inflation, interest rates, and overall economic stability within Pakistan influence investor sentiment towards gold as a safe-haven asset, impacting demand and consequently, prices.

-

Geopolitical Events: Global political instability, economic sanctions, and trade wars often lead investors towards safe-haven assets like gold, influencing its price globally and subsequently in Pakistan.

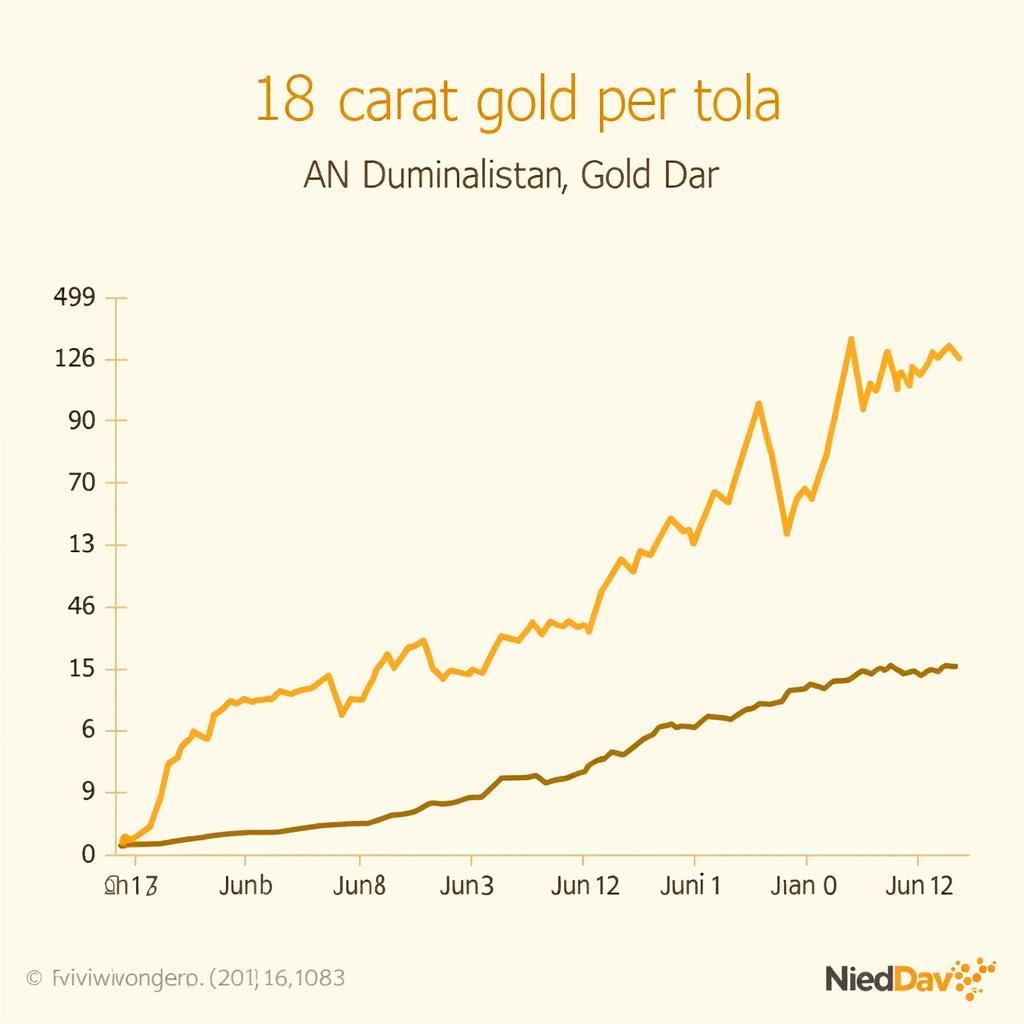

Gold Price Chart Pakistan

Gold Price Chart Pakistan

Understanding Gold Karats

The karat system denotes the purity of gold, with 24 karats representing pure gold. 18 carat gold, comprising 75% pure gold and 25% other metals, strikes a balance between purity, durability, and affordability, making it a popular choice for jewelry in Pakistan.

How to Determine the Current 18 Carat Gold Price in Pakistan

-

Reputable Jewelers: Established jewelers across major cities in Pakistan provide daily updated gold rates, often displayed prominently in their stores and on their websites.

-

Online Platforms: Several reputable online platforms dedicated to precious metal trading offer live gold prices, including the 18 carat variant, specific to the Pakistani market.

-

Financial News Sources: Leading financial newspapers and websites regularly publish updated gold rates, providing insights into market trends and analysis.

Investment Potential of 18 Carat Gold

Gold, being a tangible asset with inherent value, has long been considered a hedge against inflation and economic uncertainty. Investing in 18 carat gold, particularly in the form of jewelry or coins, can act as a store of value and provide potential long-term returns.

Tips for Buying 18 Carat Gold in Pakistan

-

Verify Purity: Ensure the gold is hallmarked by a reputable laboratory, guaranteeing its 18 carat purity.

-

Research Prices: Compare prices from multiple sources, including local jewelers and online platforms, to secure the best deal.

-

Negotiate Making Charges: Making charges for jewelry can vary significantly; negotiate with jewelers to obtain a fair price.

-

Consider Buyback Options: Inquire about the jeweler’s buyback policy, which can be beneficial for future liquidity.

Conclusion

The 18 carat gold price in Pakistan per tola is a fluctuating entity influenced by a complex interplay of global and local factors. By understanding these dynamics, investors and consumers can make informed decisions regarding buying, selling, or investing in this precious metal.

For the most up-to-date information on the 18 carat gold price in Pakistan per tola, it’s recommended to consult reputable jewelers, online platforms specializing in precious metals, or trusted financial news sources.

Looking for the latest iphone 15 pro max non pta price in pakistan? Check out our comprehensive guide for detailed information.