Navigating the world of real estate in Pakistan often requires a property valuation certificate. Whether you’re buying, selling, or dealing with legal matters, this document plays a vital role. This comprehensive guide delves into the intricacies of property valuation certificates in Pakistan, providing you with the knowledge to make informed decisions.

What is a Property Valuation Certificate in Pakistan?

A property valuation certificate, also known as a valuation report, is a legal document that provides an expert assessment of a property’s market value. It is prepared by a certified and licensed property valuer who considers various factors, including location, size, condition, and market trends.

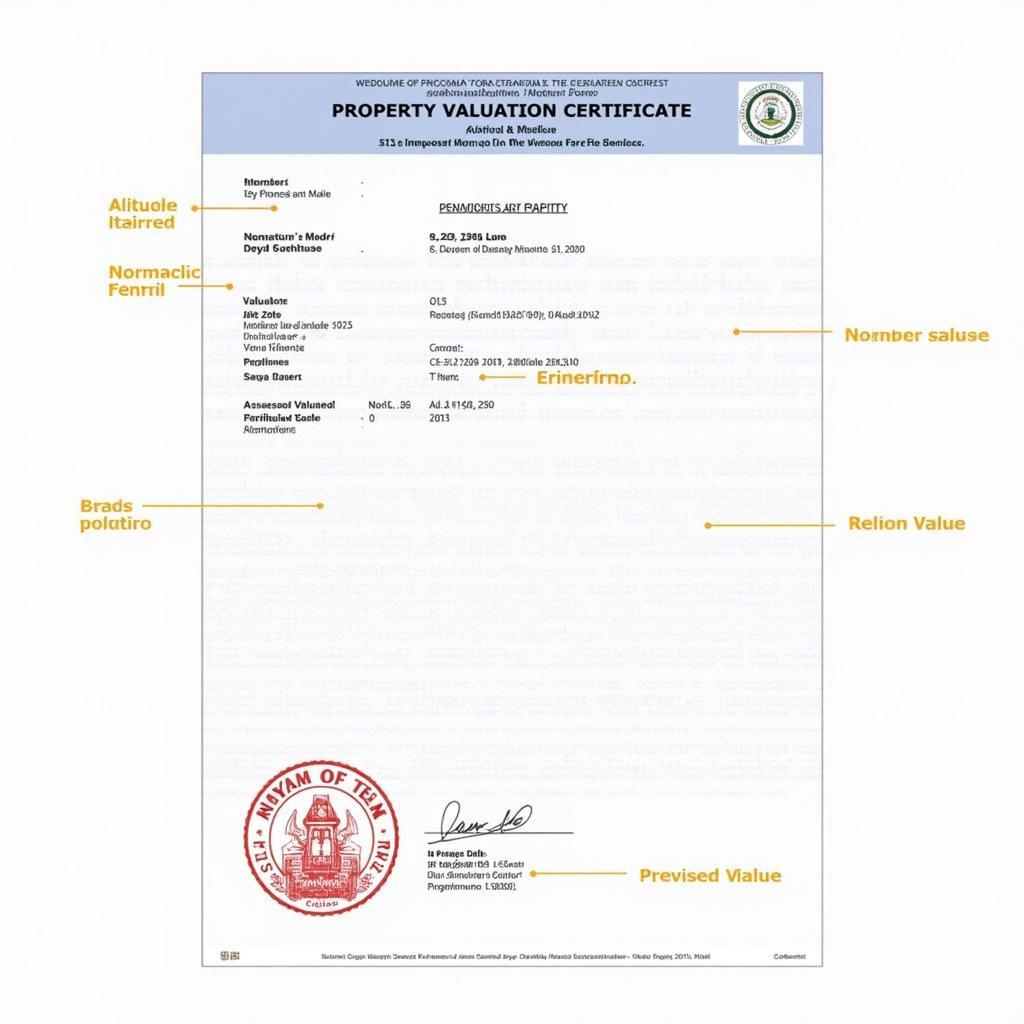

Property Valuation Certificate in Pakistan

Property Valuation Certificate in Pakistan

Why is a Property Valuation Certificate Important?

Property valuation certificates are essential for numerous reasons:

- Property Transactions: Buyers and sellers rely on these certificates to determine a fair market price, ensuring transparency and avoiding disputes.

- Legal Proceedings: Courts often require valuation certificates for property division during inheritance cases, divorce settlements, or tax assessments.

- Mortgage Applications: Banks and financial institutions mandate valuation certificates to assess the loan amount they can offer against a property.

- Insurance Purposes: Insurance companies utilize these certificates to determine the appropriate coverage amount for a property.

- Government Regulations: Government bodies may request valuation certificates for development projects, land acquisition, or property tax calculations.

Who Can Issue a Property Valuation Certificate in Pakistan?

Only certified and licensed property valuers registered with the Pakistan Banks’ Association (PBA) are authorized to issue property valuation certificates. These valuers undergo rigorous training and possess in-depth knowledge of the real estate market.

Factors Affecting Property Valuation in Pakistan

Several factors influence the valuation of a property in Pakistan:

- Location: Proximity to amenities, schools, hospitals, and transportation hubs significantly impacts property value.

- Size and Area: The plot size, covered area, and number of rooms contribute to the overall value.

- Property Condition: Well-maintained properties generally command higher values compared to those requiring repairs or renovations.

- Market Trends: Fluctuations in supply and demand, economic conditions, and interest rates influence property prices.

- Legal Status: Clear title deeds and proper documentation are crucial for a fair valuation.

How to Obtain a Property Valuation Certificate in Pakistan

Follow these steps to obtain a property valuation certificate:

- Find a Certified Valuer: Contact the PBA or reputable real estate agencies to find a licensed property valuer.

- Submit Required Documents: Provide the valuer with all necessary documents, including property ownership proof, layout plans, and previous valuation certificates (if any).

- Property Inspection: The valuer will physically inspect the property to assess its condition, size, and features.

- Market Analysis: The valuer will conduct thorough market research to determine comparable property values in the vicinity.

- Valuation Report: Once the assessment is complete, the valuer will prepare a detailed valuation report, including their findings and the assessed market value.

Cost of Property Valuation Certificate in Pakistan

The cost of a property valuation certificate varies depending on factors like the property’s size, location, and the valuer’s fee structure. Typically, valuers charge a percentage of the assessed property value.

Tips for Choosing a Property Valuer

- Verify Credentials: Ensure the valuer is registered with the PBA and holds a valid license.

- Experience and Reputation: Choose a valuer with significant experience and a good track record in the industry.

- Transparency: Opt for a valuer who provides clear communication, explains their methodology, and answers your queries comprehensively.

- Client Feedback: Seek recommendations from previous clients or check online reviews to gauge the valuer’s professionalism and reliability.

Conclusion

A property valuation certificate is an indispensable document for various real estate transactions and legal matters in Pakistan. Understanding its importance, the factors influencing valuation, and the process of obtaining one empowers you to navigate property matters with confidence. Remember to engage a certified and experienced valuer to ensure a fair and accurate assessment of your property’s worth.

If you are considering investing in other financial instruments, you might find valuable information on our page dedicated to Pakistan investment bonds. This resource offers insights into another avenue for growing your wealth in Pakistan’s dynamic financial landscape.

FAQs about Property Valuation Certificate in Pakistan

1. How long is a property valuation certificate valid?

A property valuation certificate is typically valid for six months from the date of issuance. After this period, a fresh valuation may be required.

2. Can I challenge a property valuation certificate?

Yes, if you disagree with the assessed value, you can request a review or seek a second opinion from another certified valuer.

3. Is it mandatory to obtain a property valuation certificate for all property transactions?

While not always mandatory, it is highly recommended to obtain a valuation certificate for transparency, fairness, and legal protection.

4. What documents do I need to provide for property valuation?

You’ll generally need property ownership proof, layout plans, tax receipts, and any previous valuation certificates.

5. How long does it take to receive a property valuation certificate?

The time frame can vary depending on the property’s complexity and the valuer’s workload, but it typically takes a few days to a week.

6. What is the difference between market value and assessed value?

Market value represents the price a property is likely to fetch in the current market, while assessed value is determined by government authorities for tax purposes.

7. Can I use a property valuation certificate obtained for one purpose for another purpose?

The acceptability of a valuation certificate for different purposes depends on the specific requirements of each situation. It’s best to consult with the relevant parties involved.

Seeking expert guidance on property valuation in Pakistan?

Contact us today! Our team of experienced professionals is here to assist you. Call: +923337849799, Email: news.pakit@gmail.com or visit our office located at Dera Ghazi Khan Rd, Rakhni, Barkhan, Balochistan, Pakistan. We offer 24/7 customer support.

Explore further insights into property matters in Pakistan:

- Property Taxes in Pakistan

- Real Estate Investment Opportunities

- Land Registration Procedures

Get in touch for tailored advice and comprehensive solutions.