The price of 1 kg of copper in Pakistan today is a common search query for individuals and businesses alike. As a crucial raw material in various industries, from construction to electronics, the copper price constantly fluctuates due to a complex interplay of global supply, demand, and economic factors. This comprehensive guide delves deep into the copper market, providing valuable insights into the factors influencing prices, historical trends, and potential future projections.

Understanding Copper’s Significance

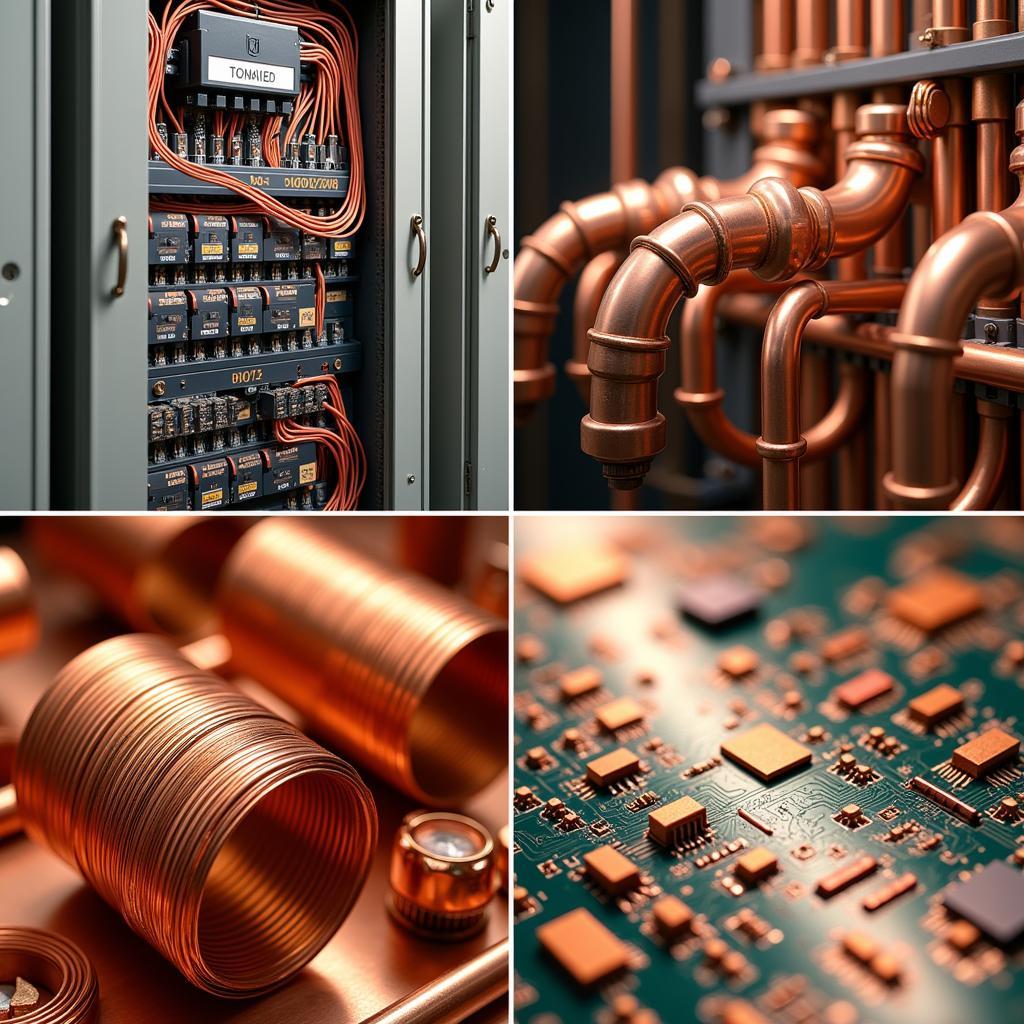

Copper’s unique properties, including its high electrical and thermal conductivity, corrosion resistance, and malleability, make it indispensable across numerous sectors. The construction industry utilizes copper extensively in electrical wiring, plumbing, and roofing. The electronics sector relies heavily on copper for wiring, connectors, and printed circuit boards.

Copper Applications

Copper Applications

Factors Influencing Copper Prices in Pakistan

-

Global Supply and Demand: As with any commodity, copper prices are heavily influenced by the fundamental economic principle of supply and demand. Production disruptions, such as mine closures or geopolitical instability in major copper-producing countries like Chile and Peru, can constrict supply and drive up prices. Conversely, weak global demand, often linked to economic slowdowns, can lead to price decreases.

-

US Dollar Fluctuations: Copper is traded internationally in US dollars. Consequently, fluctuations in the value of the Pakistani Rupee against the US dollar directly impact the price of imported copper. A stronger US dollar makes copper more expensive for Pakistani buyers.

-

Inventory Levels: Global copper stockpiles, particularly those held in major metal exchanges like the London Metal Exchange (LME), provide insights into market sentiment. Depleting inventories often indicate strong demand and can contribute to price increases, while rising inventories may signal weakening demand and put downward pressure on prices.

-

Economic Indicators: The performance of major economies, especially China, a leading consumer of copper, significantly impacts demand. Robust economic growth in China typically translates into higher demand for construction and infrastructure projects, driving up copper consumption and prices.

Historical Copper Price Trends in Pakistan

Analyzing historical copper price trends reveals valuable insights into market dynamics and potential future movements. Over the past decade, copper prices have experienced periods of both boom and bust. The period from 2010 to 2011 witnessed a surge in prices, reaching record highs driven by strong Chinese demand and supply constraints. Conversely, prices slumped between 2015 and 2016 due to concerns about slowing Chinese economic growth and a global commodity downturn.

Historical Copper Price Chart

Historical Copper Price Chart

Forecasting Future Copper Prices

Predicting future copper prices with absolute certainty is impossible due to the complex interplay of influencing factors. However, several key indicators and emerging trends provide insights into potential price trajectories:

-

Renewable Energy Transition: The global shift towards renewable energy sources, particularly solar and wind power, is expected to fuel long-term copper demand. These technologies require significantly more copper than traditional fossil fuel-based power generation.

-

Electric Vehicle Revolution: The rapid adoption of electric vehicles (EVs) represents another significant driver of future copper demand. EVs utilize considerably more copper than internal combustion engine vehicles, primarily in their batteries, motors, and wiring systems.

-

Infrastructure Development: Ambitious infrastructure projects, both in Pakistan and globally, are anticipated to sustain copper demand in the coming years. These projects often require vast amounts of copper for electrical grids, transportation networks, and public utilities.

Conclusion

Staying informed about the factors influencing copper prices is crucial for businesses and individuals in Pakistan. By understanding the dynamics of global supply and demand, tracking economic indicators, and monitoring emerging trends like the renewable energy and electric vehicle revolutions, stakeholders can make more informed decisions regarding their copper procurement strategies.

FAQs about Copper Prices in Pakistan

1. How often do copper prices change?

Copper prices are highly volatile and can fluctuate multiple times within a single day. These fluctuations are driven by real-time trading activities in global commodity exchanges.

2. Where can I find the most up-to-date copper prices in Pakistan?

Reputable sources for real-time copper prices include online financial platforms like Bloomberg, Reuters, and Trading Economics, as well as websites of major metal exchanges like the LME.

3. What is the difference between copper grades and how do they affect prices?

Copper is categorized into different grades based on purity levels. The most commonly traded grade is “Grade A” or “Electrolytic Copper,” which is 99.9% pure and commands a premium price. Lower-grade copper typically has a lower price point.

4. How does the scrap copper market impact copper prices?

The scrap copper market plays a significant role in the overall copper supply chain. Increased availability of scrap copper can potentially alleviate supply constraints and exert downward pressure on prices.

5. Are there any government regulations that impact copper prices in Pakistan?

Import tariffs and taxes levied on copper imports can influence the final price of copper in Pakistan. Changes in these regulations can directly impact domestic copper prices.

6. What is the outlook for copper prices in the long term?

While forecasting commodity prices is inherently uncertain, the long-term outlook for copper appears positive due to factors like growing demand from renewable energy, electric vehicles, and infrastructure development.

7. What are some potential risks to the copper price outlook?

Potential risks to the copper price outlook include a global economic slowdown, technological advancements that reduce copper dependence, and geopolitical instability in major copper-producing regions.

Need Help Navigating the Copper Market?

For personalized guidance on navigating the complexities of the copper market, feel free to contact our team of experts. Reach us at:

Phone: +923337849799

Email: news.pakit@gmail.com

Address: Dera Ghazi Khan Rd, Rakhni, Barkhan, Balochistan, Pakistan

Our dedicated customer support team is available 24/7 to assist you with any queries or concerns.