Becoming a chartered accountant (CA) in Pakistan is a highly respected and rewarding career path. The journey requires dedication, hard work, and a deep understanding of various subjects. This comprehensive guide will provide you with a detailed overview of the CA subjects list in Pakistan, helping you navigate your path to success.

The CA Subjects List in Pakistan: A Detailed Overview

The Institute of Chartered Accountants of Pakistan (ICAP) sets the curriculum for CA students. The program is divided into two levels:

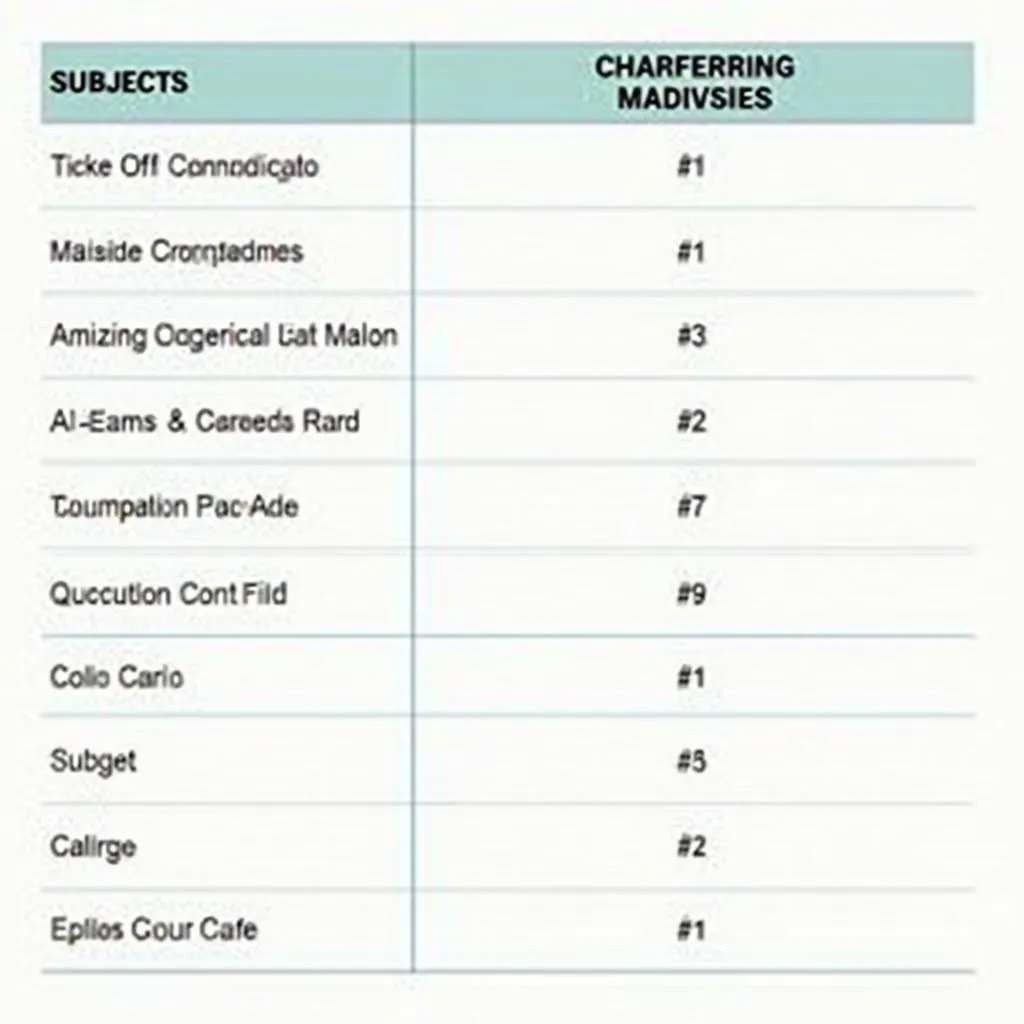

Level 1: Foundation Level

- Business and Finance (Paper 1): This subject covers the fundamentals of accounting, business, economics, and finance, laying the foundation for your CA journey.

- Financial Accounting (Paper 2): This subject delves into the principles and practices of financial accounting, covering topics such as accounting standards, financial statements, and financial reporting.

- Auditing and Assurance (Paper 3): Here, you’ll learn about the concepts and techniques of auditing, internal control, and assurance engagements.

- Taxation (Paper 4): This subject focuses on the Pakistani tax system, covering income tax, sales tax, and other relevant tax laws.

- Business Law (Paper 5): This subject introduces you to the legal framework of business operations, covering topics such as contract law, company law, and commercial law.

Level 2: Professional Level

- Financial Reporting (Paper 1): This subject explores advanced financial reporting principles and practices, including IFRS (International Financial Reporting Standards) and accounting for specific industries.

- Auditing and Assurance (Paper 2): This subject goes in-depth into the intricacies of auditing and assurance engagements, including risk assessment, audit planning, and reporting.

- Taxation (Paper 3): This subject covers advanced taxation concepts and practices, including tax planning, wealth management, and tax controversy resolution.

- Strategic Finance (Paper 4): This subject explores the role of finance in strategic decision-making, covering topics such as financial modeling, investment appraisal, and risk management.

- Professional Ethics and Governance (Paper 5): This subject focuses on the ethical principles and governance framework that govern the accounting profession, emphasizing professional integrity and responsibility.

What are the key challenges of studying these subjects?

“The CA curriculum is rigorous and demands a high level of commitment,” says Dr. Farhan Khan, a renowned CA and academic. “Students need to be adept at understanding complex concepts, applying theoretical knowledge to real-world scenarios, and staying updated on the latest industry developments.”

How can I prepare effectively for the CA exams in Pakistan?

“Effective preparation is key to success,” says Ms. Sarah Ahmed, a seasoned CA tutor. “Students should dedicate sufficient time to studying, understand the exam pattern, and practice mock exams regularly. Joining a reputable coaching institute can also be beneficial.”

Frequently Asked Questions about Chartered Accountant Subjects in Pakistan

Q1: What is the eligibility criteria for the CA program in Pakistan?

A1: To be eligible for the CA program, you must have a bachelor’s degree in commerce, business administration, or a related field. The minimum required GPA varies depending on the institute.

Q2: What are the career opportunities for a chartered accountant in Pakistan?

A2: Chartered accountants have a wide range of career options in various sectors, including:

- Financial Accounting & Reporting

- Auditing & Assurance

- Taxation

- Financial Planning & Analysis

- Investment Banking

- Corporate Finance

- Management Consultancy

Q3: How can I find a job as a chartered accountant in Pakistan?

A3: You can find job opportunities by:

- Applying for open positions on job boards like Indeed, Rozee.pk, and Bayt.com.

- Networking with professionals in your field.

- Attending career fairs.

- Contacting recruitment agencies specializing in finance and accounting.

Q4: Are there any resources available to help me prepare for the CA exams?

A4: Yes, there are many resources available, including:

- ICAP website

- Reputable coaching institutes

- Online study materials and courses

- CA study groups and forums

Q5: What are some tips for managing time and stress while preparing for the CA exams?

A5: Here are some helpful tips:

- Create a realistic study schedule and stick to it.

- Break down large tasks into smaller, manageable steps.

- Prioritize your studies and focus on the most important topics.

- Take regular breaks to avoid burnout.

- Seek support from friends, family, or a mentor.

- Practice mindfulness techniques to reduce stress.

Conclusion:

The Chartered Accountant program in Pakistan is a challenging but rewarding journey. By understanding the subjects, preparing effectively, and staying motivated, you can achieve your goal of becoming a successful and respected CA. Remember, the path to becoming a CA is not easy, but the rewards are substantial.

The CA Subjects List in Pakistan

The CA Subjects List in Pakistan

Career Opportunities for Chartered Accountants in Pakistan

Career Opportunities for Chartered Accountants in Pakistan

Tips for Success in the CA Exams

Tips for Success in the CA Exams

Do you have more questions about the CA subjects list in Pakistan or need assistance with your preparation? Contact us today for personalized support and guidance!