Understanding Cheque Withdrawal Charges In Pakistan is crucial for managing your finances effectively. This guide will delve into the various aspects of these charges, providing you with the necessary information to navigate the banking landscape.

Decoding Cheque Withdrawal Charges

Cheque withdrawal charges are fees levied by banks for processing and clearing cheques. These charges vary depending on the bank, the type of account, and the amount being withdrawn. They can impact your financial planning, especially for businesses and individuals who frequently use cheques.

Factors Influencing Cheque Withdrawal Charges

Several factors contribute to the variation in cheque withdrawal charges across different banks in Pakistan. Understanding these factors can help you choose the right bank and account type that suits your financial needs.

- Bank Policies: Each bank has its own fee structure, which can be influenced by internal costs and market competition.

- Account Type: Different account types, such as current accounts, savings accounts, and business accounts, often have varying fee structures. Current accounts, designed for frequent transactions, may have higher cheque withdrawal charges compared to savings accounts.

- Cheque Amount: Some banks may impose higher charges for withdrawing larger amounts via cheque.

- Location: Charges can also vary based on the branch location, especially in rural or remote areas.

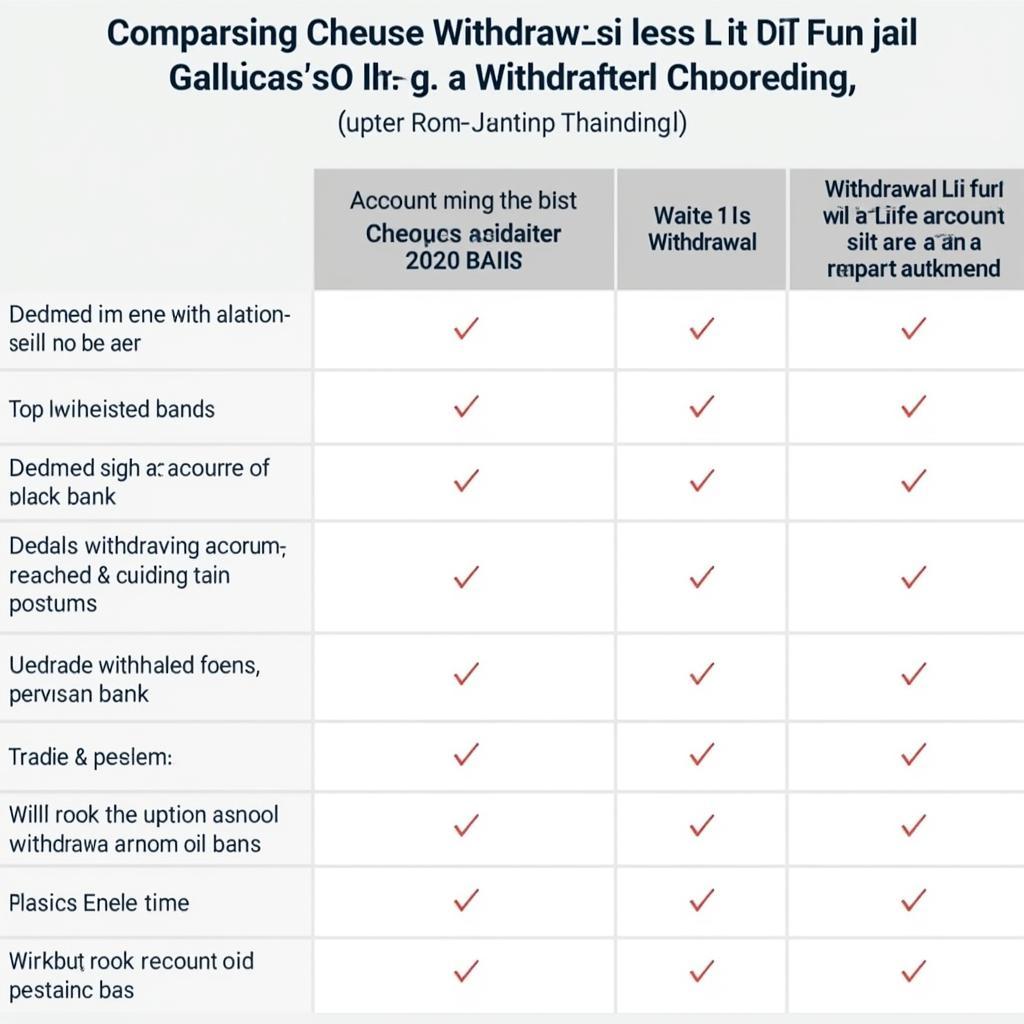

Comparison of Cheque Withdrawal Fees in Different Pakistani Banks

Comparison of Cheque Withdrawal Fees in Different Pakistani Banks

Understanding these factors allows you to make informed decisions regarding your banking practices.

Navigating Cheque Withdrawal Fees: Tips and Tricks

While cheque withdrawal charges are unavoidable, you can minimize their impact by adopting some smart banking practices.

- Choose the Right Account: Carefully research different account types offered by various banks and choose the one that aligns with your transaction frequency and volume.

- Consolidate Transactions: Minimize the number of cheques you write by combining multiple smaller transactions into a single cheque.

- Online Banking: Utilize online banking facilities for transferring funds electronically, reducing your reliance on physical cheques.

- Negotiate with your Bank: For high-volume transactions, consider negotiating with your bank for lower cheque withdrawal charges.

Online Banking Alternatives to Cheques

Online Banking Alternatives to Cheques

What are the average cheque withdrawal charges in Pakistan?

The average cheque withdrawal charges in Pakistan vary from bank to bank and can range from PKR 20 to PKR 100 or more per cheque.

How can I avoid cheque withdrawal charges?

You can avoid cheque withdrawal charges by utilizing online banking services, consolidating transactions, or choosing an account with lower fees.

The Future of Cheques in Pakistan

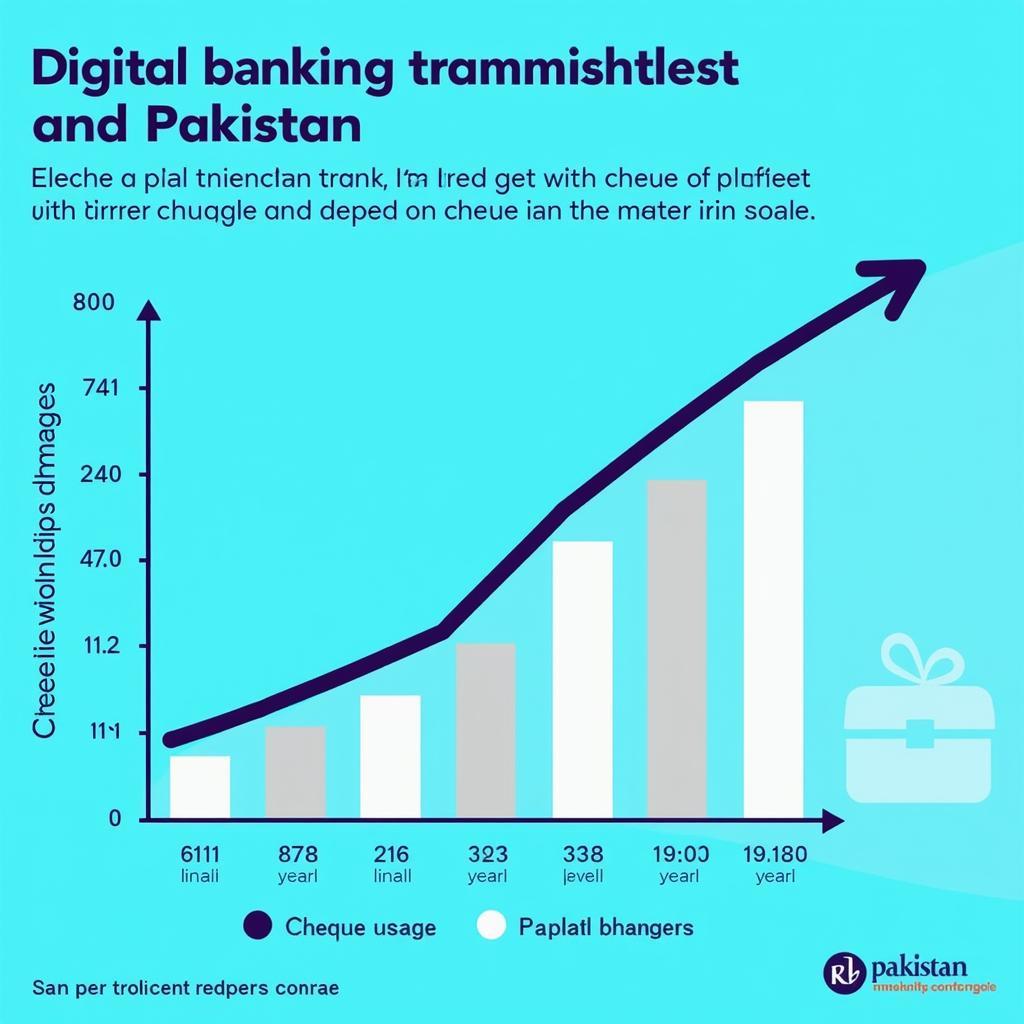

With the increasing popularity of digital banking, the use of cheques is gradually declining. However, cheques continue to play a significant role in certain business transactions and for individuals who prefer traditional banking methods.

Mr. Ali Khan, a Senior Financial Analyst at FinanceWise Pakistan, notes, “While digital transactions are on the rise, cheques still hold relevance, especially for larger transactions and in specific sectors. Understanding the associated costs is crucial for effective financial management.”

Digital Banking Trends in Pakistan

Digital Banking Trends in Pakistan

Ms. Fatima Rizvi, Head of Retail Banking at United Bank Limited, adds, “Banks are continuously innovating to provide customers with more convenient and cost-effective banking solutions. We are seeing a shift towards digital channels, and this trend is likely to continue in the future.”

Conclusion

Cheque withdrawal charges in Pakistan are an important aspect of financial planning. By understanding the factors influencing these charges and adopting smart banking practices, you can minimize their impact on your finances. Staying informed about the evolving banking landscape and exploring digital alternatives can help you make informed decisions and manage your money effectively.

FAQ

- Are cheque withdrawal charges the same across all banks? No, they vary based on bank policy and account type.

- Can I negotiate cheque withdrawal charges with my bank? Yes, especially for high-volume transactions.

- What are the alternatives to using cheques? Online banking, debit cards, and mobile wallets are viable alternatives.

- Are cheque books still relevant in the digital age? Yes, especially for certain business transactions and individuals who prefer traditional banking.

- How can I find out the cheque withdrawal charges of my bank? Contact your bank’s customer service or visit their website.

- Are there different charges for local and outstation cheques? Yes, some banks might have different charges based on the location.

- Can I withdraw cash from a cheque at any branch of my bank? Generally, yes, but it’s best to confirm with your bank.

Need further assistance? Contact us at Phone Number: +923337849799, Email: [email protected] or visit our office at Dera Ghazi Khan Rd, Rakhni, Barkhan, Balochistan, Pakistan. We have a 24/7 customer support team.