International transactions are becoming increasingly common in Pakistan, thanks to the rise of e-commerce, online freelancing, and globalized businesses. Understanding the associated charges is crucial for managing your finances effectively. This article will delve into the various aspects of International Transaction Charges In Pakistan, equipping you with the knowledge to navigate these costs wisely.

Decoding International Transaction Charges: A Comprehensive Guide

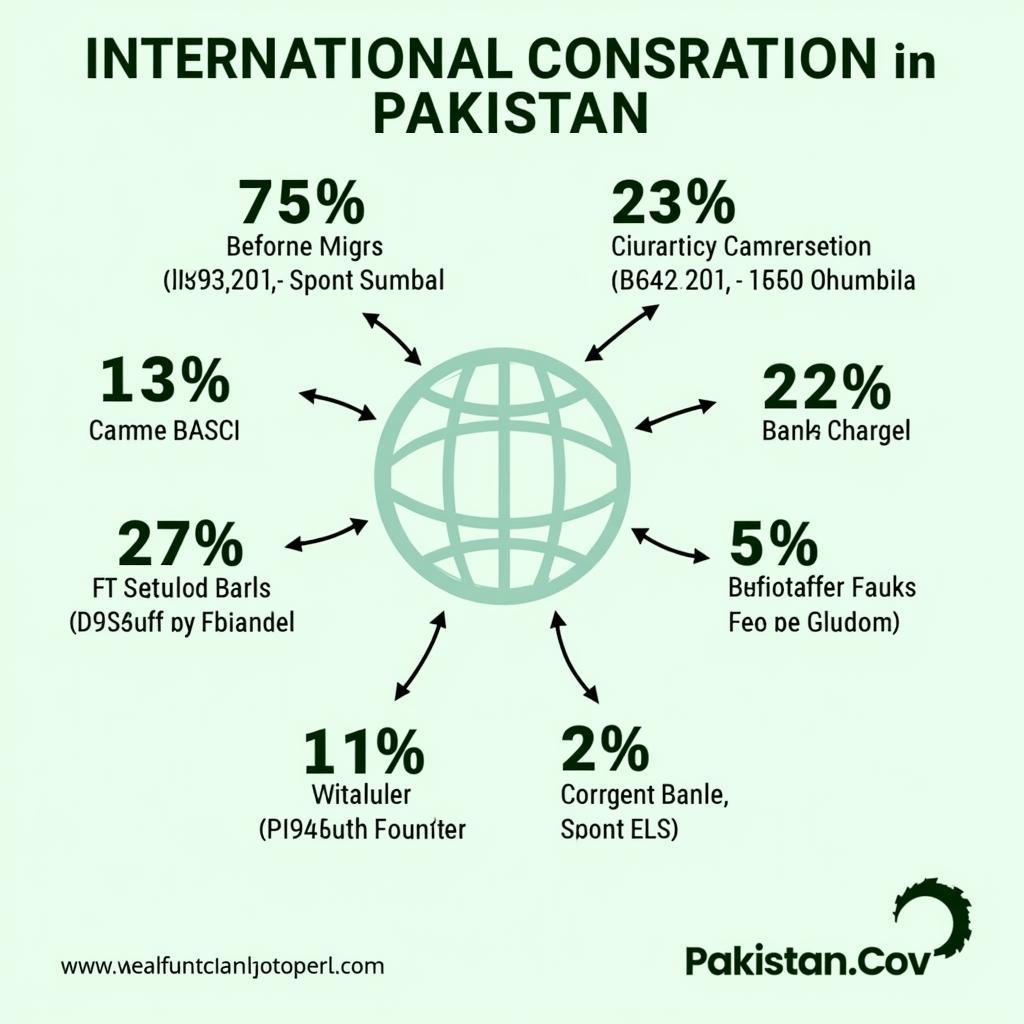

When you make a purchase from an international vendor or send money abroad, various charges can be levied. These “international transaction charges in pakistan” can significantly impact your overall spending. It’s essential to be aware of these charges to avoid any unpleasant surprises.  International Transaction Charges in Pakistan

International Transaction Charges in Pakistan

What Factors Influence International Transaction Charges?

Several factors influence the final cost of your international transactions, including:

- Currency Conversion: Converting Pakistani Rupees (PKR) to another currency involves a conversion fee, often based on the prevailing exchange rate.

- Bank Charges: Your bank in Pakistan will likely charge a fee for processing the international transaction. This fee can vary depending on the bank and the type of transaction.

- Intermediary Bank Fees: Sometimes, international transactions involve intermediary banks. Each intermediary bank may deduct a fee, increasing the overall cost.

- Receiving Bank Charges: The recipient’s bank might also have its own set of charges for receiving international funds.

- Payment Network Fees: Payment networks like Visa, Mastercard, or SWIFT also charge fees for facilitating the transaction.

Navigating International Transaction Fees in Pakistan

Minimizing international transaction charges is a priority for many. Here are some strategies to consider:

- Compare Bank Charges: Different banks have varying fee structures. Research and compare the international transaction charges of different banks in Pakistan to find the most cost-effective option. 22k gold ring price in pakistan today

- Use Forex Cards: Consider using prepaid forex cards for international transactions. These cards often offer better exchange rates and lower fees compared to traditional debit or credit cards. bank account opening requirements in pakistan

- Negotiate with Your Bank: For larger transactions, try negotiating with your bank for a reduced fee.

- Be Mindful of Exchange Rates: Be aware of the current exchange rate and try to transact when the rates are favorable. 1 masha gold price in pakistan

Tips for Reducing International Transaction Costs

Tips for Reducing International Transaction Costs

Why are International Transaction Charges Necessary?

While these charges can seem burdensome, they cover the costs involved in processing international transactions. These costs include currency conversion, security measures, and the infrastructure required to facilitate cross-border payments. 10 masha gold price in pakistan

What are the Typical International Transaction Charges in Pakistan?

The exact charges vary depending on the bank and the specifics of the transaction. However, you can generally expect charges ranging from 1% to 3% of the transaction amount. today gold rate in multan pakistan

Expert Insight: Ahsan Khan, a financial advisor based in Karachi, says, “Understanding these charges is essential for anyone engaging in international transactions. Being proactive in comparing and negotiating fees can significantly reduce your overall costs.”

International Banking Transactions in Pakistan

International Banking Transactions in Pakistan

Conclusion

Navigating international transaction charges in Pakistan requires awareness and proactive planning. By understanding the various fees involved and implementing strategies to minimize costs, you can make informed decisions about your international transactions. Remember to compare bank charges, consider forex cards, and negotiate with your bank to secure the best possible rates for your international transaction charges in Pakistan.

FAQ:

- What are international transaction charges?

- How can I minimize these charges?

- Do all banks charge the same fees?

- What is a forex card?

- Are there hidden charges I should be aware of?

- What is the role of intermediary banks?

- How are currency conversion rates determined?

For further assistance, please contact us at Phone: +923337849799, Email: [email protected] or visit our office at Dera Ghazi Khan Rd, Rakhni, Barkhan, Balochistan, Pakistan. We offer 24/7 customer support.