Understanding Filer Benefits In Pakistan is crucial for anyone seeking financial stability and access to various services. This comprehensive guide explores the numerous advantages associated with becoming a filer, empowering you to make informed decisions about your financial future.

What Does it Mean to be a Filer in Pakistan?

Becoming a filer simply means registering with the Federal Board of Revenue (FBR) and filing your annual income tax return. While it might seem like an administrative task, being a filer unlocks a world of benefits that can significantly impact your financial well-being. These benefits extend to various aspects of life, from accessing loans and government schemes to enjoying reduced withholding taxes. benefits of being filer in pakistan Many find that the advantages far outweigh the effort involved in filing.

Unveiling the Key Filer Benefits in Pakistan

The advantages of being a filer are numerous and diverse, catering to a wide range of financial needs. Some of the key filer benefits in Pakistan include lower tax rates on various transactions, easier access to financial products like loans and credit cards, and eligibility for government schemes and subsidies. For example, filers often enjoy reduced withholding tax on cash withdrawals, dividends, and profits from various investments.

Reduced Withholding Taxes: A Major Advantage for Filers

One of the most significant filer benefits in Pakistan is the reduction in withholding taxes. This means filers pay less tax on several financial transactions, leaving more money in their pockets. These reduced rates apply to a variety of areas, including:

- Cash Withdrawals: Filers enjoy significantly lower withholding tax rates when withdrawing cash from banks.

- Vehicle Registration: The tax levied on vehicle registration is lower for filers, making car ownership more affordable.

- Property Transactions: Filers benefit from reduced taxes on property purchases and sales, encouraging investment in real estate.

Easier Access to Financial Products and Services

Being a filer makes it easier to access a wider range of financial products and services. Banks and other financial institutions view filers as more credible borrowers, increasing the likelihood of loan approval and offering better terms. This is a crucial advantage for those seeking loan against gold in pakistan or other forms of financing.

- Loans: Filers often qualify for larger loan amounts and lower interest rates.

- Credit Cards: Obtaining a credit card is easier and often comes with better benefits for filers.

- Investments: Certain investment opportunities are exclusively available to filers.

Who Should Become a Filer in Pakistan?

While everyone can benefit from becoming a filer, it is especially advantageous for:

- Salaried Individuals: Filing taxes helps ensure compliance and unlocks potential tax refunds.

- Business Owners: Filing is essential for business legitimacy and accessing various financial benefits.

- Investors: Reduced taxes on investments make filing crucial for maximizing returns.

How to Become a Filer in Pakistan: A Simple Guide

Becoming a filer is a straightforward process:

- Obtain a National Tax Number (NTN): This can be done online through the FBR website or by visiting a designated FBR office.

- File Your Tax Return: Submit your annual income tax return through the online portal or designated banks.

- Maintain Accurate Records: Keep track of all income and expenses to ensure accurate filing.

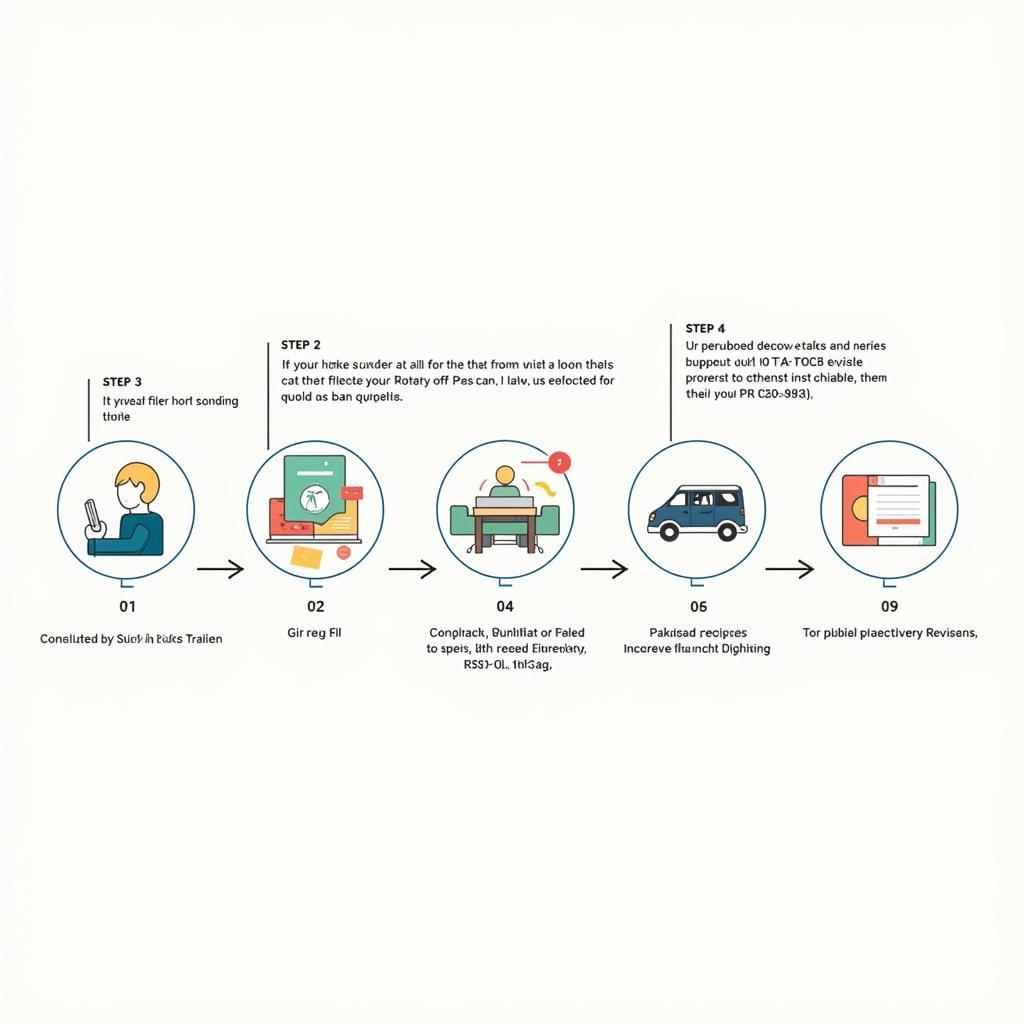

Becoming a Filer in Pakistan: Step-by-step guide with visuals.

Becoming a Filer in Pakistan: Step-by-step guide with visuals.

Conclusion: Reap the Rewards of Becoming a Filer in Pakistan

Understanding and utilizing filer benefits in Pakistan is essential for financial success. By becoming a filer, you unlock a world of opportunities, from reducing your tax burden to gaining easier access to essential financial services. Take the first step towards financial empowerment and reap the numerous benefits of being a filer.

FAQs about Filer Benefits in Pakistan

- What is the deadline for filing taxes in Pakistan? Typically, the deadline is September 30th of each year.

- Are there penalties for not filing taxes? Yes, failure to file can result in penalties and legal action.

- Can I file my taxes online? Yes, the FBR provides an online portal for easy tax filing.

- What documents are required for filing taxes? Required documents include your CNIC, salary slips, and bank statements.

- How can I check my filer status? You can check your filer status through the FBR website.

- What are the benefits of filing taxes for students? While students may not have taxable income, being a filer can be beneficial for future financial endeavors.

- Can filers access government schemes? Yes, many government schemes and subsidies are exclusively available to filers.

For further information on related topics, you can explore our articles on benefits of filer in pakistan and artificial nails online pakistan. If you require assistance, please contact us. Our team is available 24/7 to provide support. You can reach us at +923337849799, news.pakit@gmail.com, or visit our office at Dera Ghazi Khan Rd, Rakhni, Barkhan, Balochistan, Pakistan.