Gold loan calculators in Pakistan are essential tools for anyone considering leveraging their gold assets for financial needs. These calculators provide quick and easy estimates of loan amounts, interest rates, and repayment schedules, empowering borrowers to make informed decisions. In today’s economy, understanding how these calculators work and the factors affecting gold loans is more crucial than ever.

Understanding Gold Loans in Pakistan

Gold loans are a popular financing option in Pakistan, particularly for those who may not qualify for traditional bank loans. They offer a secured loan against the value of your gold ornaments, allowing you to access funds quickly and easily. The loan amount is typically a percentage of the current market value of your gold, ensuring the lender is protected in case of default.

Benefits of Using a Gold Loan Calculator

Using a gold loan calculator offers several advantages:

- Transparency: Calculators provide a clear picture of the potential loan terms.

- Convenience: Quickly compare offers from different lenders without visiting physical branches.

- Informed Decisions: Empowers you to negotiate better terms based on your calculations.

- Financial Planning: Helps you budget and plan repayments effectively.

How to Use a Gold Loan Calculator Pakistan

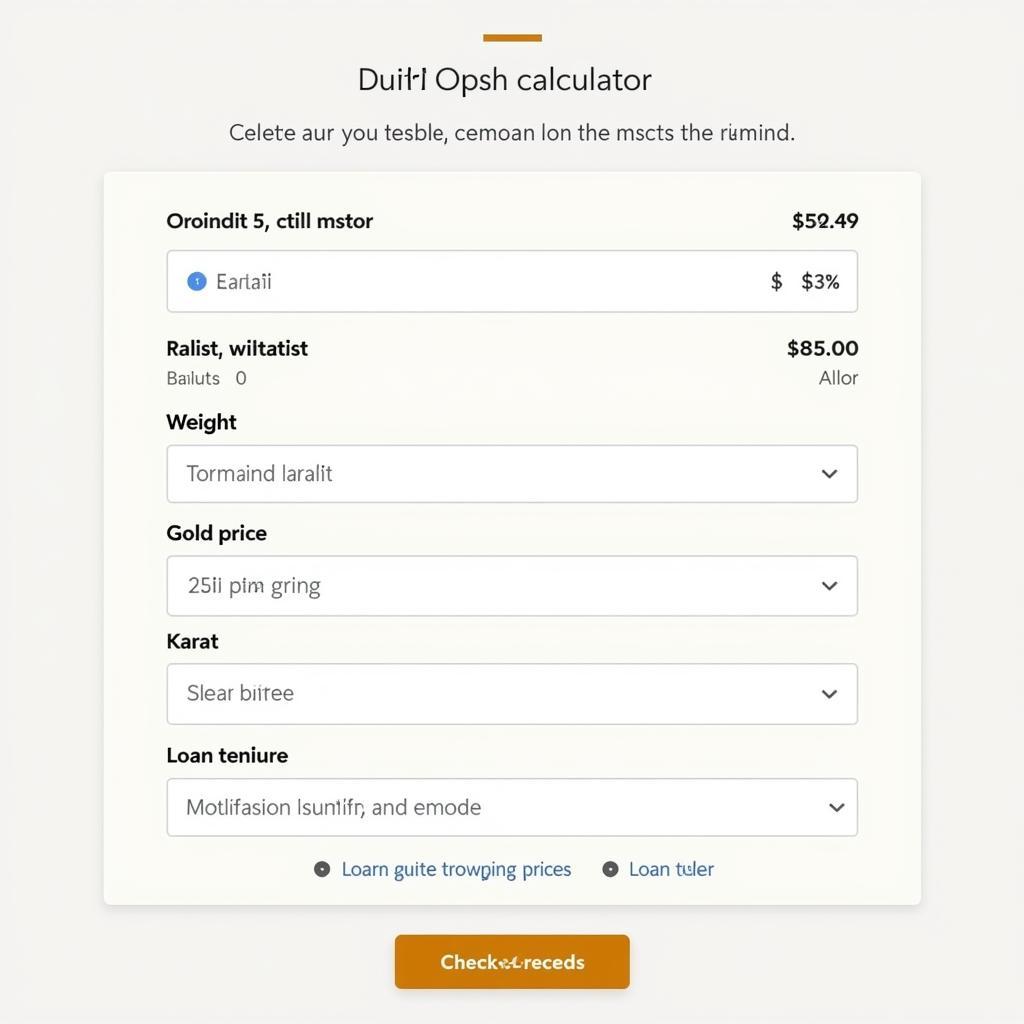

Most gold loan calculators require you to input the following information:

- Weight of Gold: Enter the weight of your gold ornaments in grams or tolas.

- Karatage: Select the purity of your gold (e.g., 24K, 22K, 18K).

- Current Gold Price: Enter the prevailing gold rate per gram or tola.

- Loan Tenure: Choose your desired repayment period.

Gold Loan Calculator Interface

Gold Loan Calculator Interface

Once you input this information, the calculator will generate an estimated loan amount, applicable interest rate, and potential monthly installments.

Factors Affecting Your Gold Loan Amount

Several factors influence the loan amount you can receive:

- Gold Purity: Higher karat gold fetches a higher loan amount.

- Gold Weight: The heavier your gold, the more you can borrow.

- Current Market Price: Loan amounts fluctuate with gold prices.

- Lender’s Policies: Each lender has its own loan-to-value (LTV) ratio.

Choosing the Right Gold Loan Lender in Pakistan

While a gold loan calculator is helpful, it’s crucial to choose a reputable lender. Consider factors such as:

- Interest Rates: Compare rates from different lenders to secure the best deal.

- Repayment Terms: Look for flexible repayment options.

- Processing Fees: Be aware of any associated fees and charges.

- Reputation and Credibility: Choose a trusted and established financial institution.

Conclusion: Empowering Your Financial Decisions with a Gold Loan Calculator Pakistan

A Gold Loan Calculator Pakistan is an invaluable tool for anyone considering this financing option. It provides a transparent and convenient way to estimate loan amounts and make informed decisions. By understanding the factors affecting your loan and choosing the right lender, you can leverage your gold assets effectively to meet your financial needs.

FAQ

- What is the maximum loan tenure for a gold loan in Pakistan?

- Can I prepay my gold loan?

- What happens if I default on my gold loan?

- Is it safe to take a gold loan?

- Are there any hidden charges associated with gold loans?

- What documents are required for a gold loan in Pakistan?

- How is the gold appraised for a loan?

For further information on financing options, see our article on casio price in pakistan. You might also be interested in other financial tools available in Pakistan.

When you need assistance, please contact us at Phone Number: +923337849799, Email: [email protected], or visit us at Dera Ghazi Khan Rd, Rakhni, Barkhan, Balochistan, Pakistan. We have a 24/7 customer service team.