Ca Subjects List In Pakistan is a crucial aspect for aspiring chartered accountants. This guide will delve into the detailed structure of the CA qualification program offered by the Institute of Chartered Accountants of Pakistan (ICAP), outlining the subjects at each level, the examination structure, and resources available to students.

Understanding the CA Qualification Structure in Pakistan

The CA qualification in Pakistan follows a structured path, encompassing several levels and examinations. Understanding this structure is the first step towards charting your CA journey. The program is divided into three main levels: the Certificate in Accounting and Finance (CAF), the Certified Accounting Technician (CAT), and the final Chartered Accountant (CA) qualification. Each level progressively builds on the previous one, ensuring a comprehensive understanding of accounting and finance principles.  CA Qualification Levels in Pakistan

CA Qualification Levels in Pakistan

Detailed CA Subjects List in Pakistan for Each Level

This section will provide a comprehensive list of the subjects covered at each level of the CA program.

CAF Level Subjects

The CAF level lays the foundation for accounting and finance. The subjects typically include:

- Financial Accounting: Introduction to fundamental accounting principles.

- Business Management & Behavioural Studies: Exploring business environments and organizational behavior.

- Quantitative Methods: Covering mathematical and statistical techniques relevant to accounting.

- Information Technology: Focus on IT applications in business and accounting.

CAT Level Subjects

Building upon the CAF level, the CAT level introduces more specialized subjects. Examples include:

- Audit and Assurance: Understanding auditing principles and practices.

- Taxation: An overview of the Pakistani tax system.

- Financial Reporting: Delving deeper into financial statement analysis and reporting standards.

- Management Accounting: Focusing on cost accounting and management decision-making.

CA Level Subjects

The final CA level covers advanced subjects, preparing candidates for professional practice. Some of the subjects at this level include:

- Advanced Financial Reporting: In-depth knowledge of International Financial Reporting Standards (IFRS).

- Advanced Auditing and Assurance: Complex audit scenarios and professional ethics.

- Strategic Financial Management: Focusing on strategic financial decision-making.

- Advanced Taxation: Advanced topics in taxation law and practice.

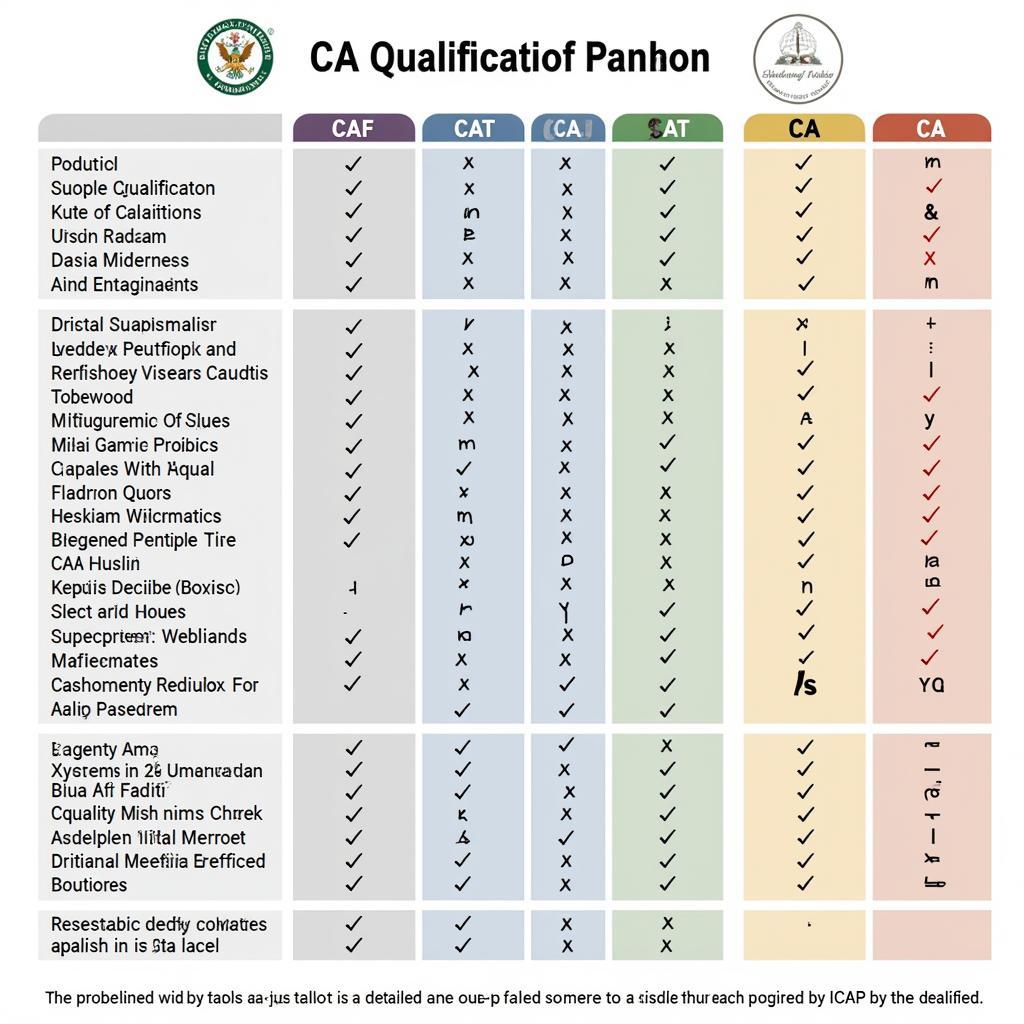

Overview of CA Subjects in Pakistan

Overview of CA Subjects in Pakistan

Preparing for the CA Exams in Pakistan

Preparing for the CA exams requires dedication, effective study strategies, and access to quality resources.

Study Resources and Tips

- ICAP Study Material: The official ICAP study materials are a primary resource.

- Past Papers: Practicing past papers is essential for familiarizing yourself with the exam format.

- Coaching Classes: Many coaching centers offer specialized CA exam preparation courses.

Exam Structure and Assessment

The CA exams are rigorous and test your understanding of the subjects covered. The assessments often include written exams, case studies, and presentations. Being familiar with the exam format is crucial for success.

Why Choose a CA Career in Pakistan?

A CA qualification opens doors to diverse career opportunities in Pakistan. Chartered Accountants are in high demand across various industries, including finance, auditing, and consulting. The bba subjects list in pakistan also provide a good foundation for a business career, although it is a different path than the CA qualification.

Conclusion

The CA subjects list in Pakistan provides a roadmap for aspiring chartered accountants. This comprehensive program equips individuals with the knowledge and skills required for a successful career in the field. By understanding the CA subjects and the overall qualification structure, you can effectively plan your studies and embark on your journey to becoming a qualified Chartered Accountant in Pakistan. Consider also exploring other related fields, like forensic science in pakistan, for diverse career opportunities. If you are a student looking for ways to fund your education, check out online jobs in pakistan without investment for students.

FAQ

- What is the duration of the CA program in Pakistan? The duration can vary depending on individual progress but typically takes around 4-5 years.

- What are the eligibility criteria for the CAF level? Generally, a higher secondary school certificate or equivalent is required.

- Is there an age limit for pursuing the CA qualification? No, there is no age limit.

- Are there scholarships available for CA students? ICAP and other organizations offer various scholarship opportunities.

- What is the scope of CA in Pakistan? The scope is vast, with opportunities in diverse sectors like finance, audit, and advisory.

- What is the passing percentage for CA exams? The passing percentage varies depending on the specific exam and level.

- Can I pursue CA after completing my bachelor’s degree? Yes, you can pursue CA after completing your bachelor’s degree, and you might be eligible for exemptions from some subjects depending on your degree specialization. If you’re considering engineering, you might find our resource on electrical engineering in pakistan universities helpful.

Situations where these questions are commonly asked:

These questions are commonly asked during career counseling sessions, university open days, and online forums for aspiring accountants. Students researching career options after high school or during their undergraduate studies frequently seek this information.

Other related articles on our website:

- Explore further details about other educational programs.

- Find career guides for various professions.

- Get access to study materials and resources.

- Read about the 9th class mutalia pakistan book if you are exploring early education options.

For any assistance, please contact us at Phone: +923337849799, Email: news.pakit@gmail.com or visit our office at Dera Ghazi Khan Rd, Rakhni, Barkhan, Balochistan, Pakistan. We have a 24/7 customer service team.