Pakistan’s custom tariff 2017-18 played a crucial role in shaping the country’s import and export landscape. This period saw significant shifts in tariff rates across various sectors, impacting businesses and consumers alike. Understanding the intricacies of this tariff structure is essential for anyone involved in international trade with Pakistan.

Decoding the Custom Tariff 2017-18 in Pakistan

The custom tariff 2017-18 in Pakistan was a comprehensive document outlining the duties levied on imported goods. It aimed to balance revenue generation with trade facilitation, promoting domestic industries while ensuring access to essential imports. The tariff structure was based on the Harmonized System (HS) of coding, allowing for international comparability and streamlined trade procedures. Changes from previous years included adjustments to rates for specific goods, reflecting evolving economic priorities and international trade agreements.

This custom tariff had a profound impact on various sectors, from agriculture to manufacturing. It influenced pricing strategies, import volumes, and the competitiveness of domestic industries. Furthermore, the tariff also impacted consumers, affecting the cost of imported goods and influencing purchasing decisions.

Impact of Pakistan's Custom Tariff 2017-18

Impact of Pakistan's Custom Tariff 2017-18

Key Features of the Custom Tariff

- HS Code-Based Classification: The tariff utilized the internationally recognized HS code system for categorizing goods, ensuring uniformity and facilitating international trade.

- Varying Tariff Rates: Different goods were subject to varying tariff rates, reflecting government policies on specific industries and products.

- Preferential Tariffs: Certain countries benefited from preferential tariff rates under existing trade agreements, fostering bilateral trade relationships.

- Exemptions and Concessions: Specific goods were granted exemptions or concessions from tariffs to support certain industries or address specific economic needs.

How did the Custom Tariff 2017-18 Affect Businesses?

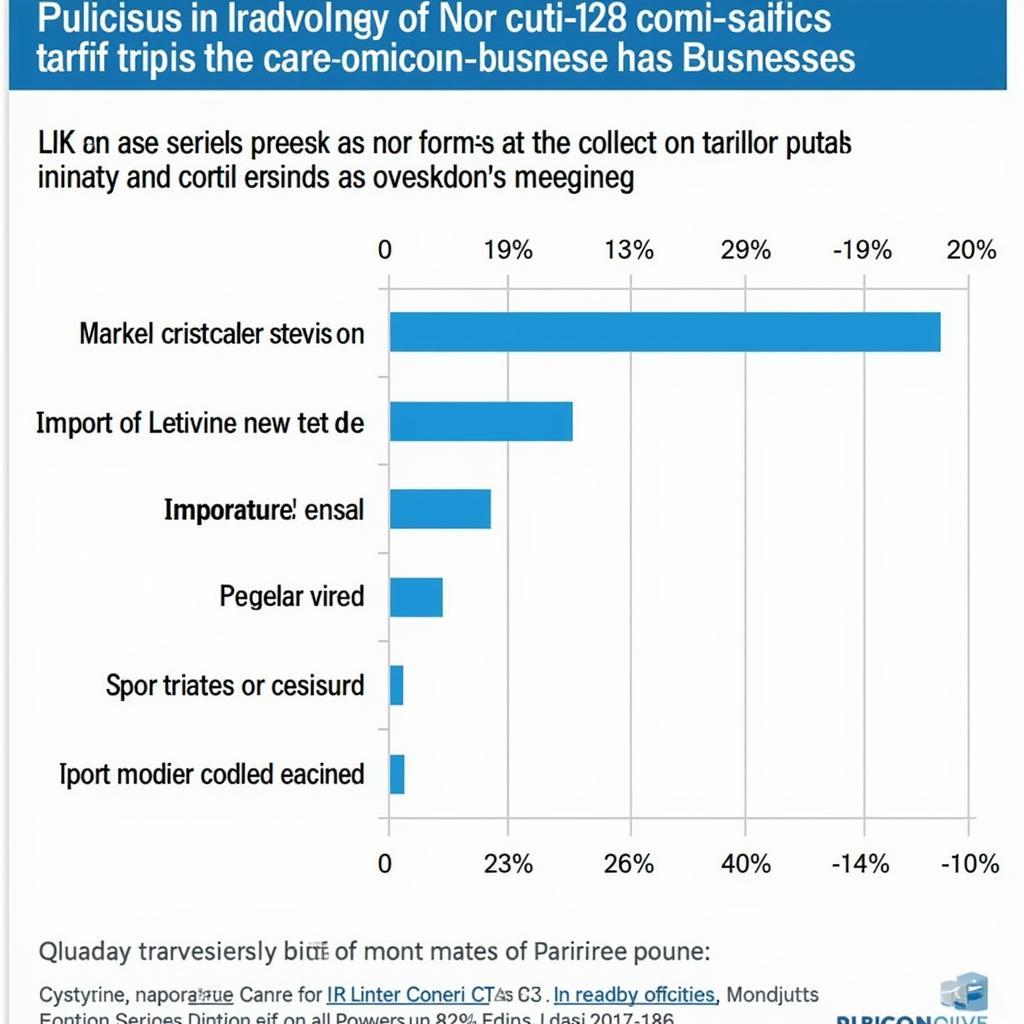

Businesses operating in Pakistan had to carefully navigate the complexities of the custom tariff 2017-18. Import costs directly impacted profitability, requiring businesses to adjust pricing strategies and sourcing decisions. The tariff also influenced the competitiveness of domestic industries, providing opportunities for growth in some sectors while posing challenges in others. For example, higher tariffs on imported raw materials could increase production costs for domestic manufacturers.

Business Implications of Pakistan's Custom Tariff

Business Implications of Pakistan's Custom Tariff

What were the implications for consumers?

The custom tariff 2017-18 directly affected the prices of imported goods available to Pakistani consumers. Higher tariffs translated to increased retail prices for certain products, influencing purchasing behavior and potentially impacting household budgets. The tariff could also impact the availability of imported goods, with some products becoming less accessible due to higher costs.

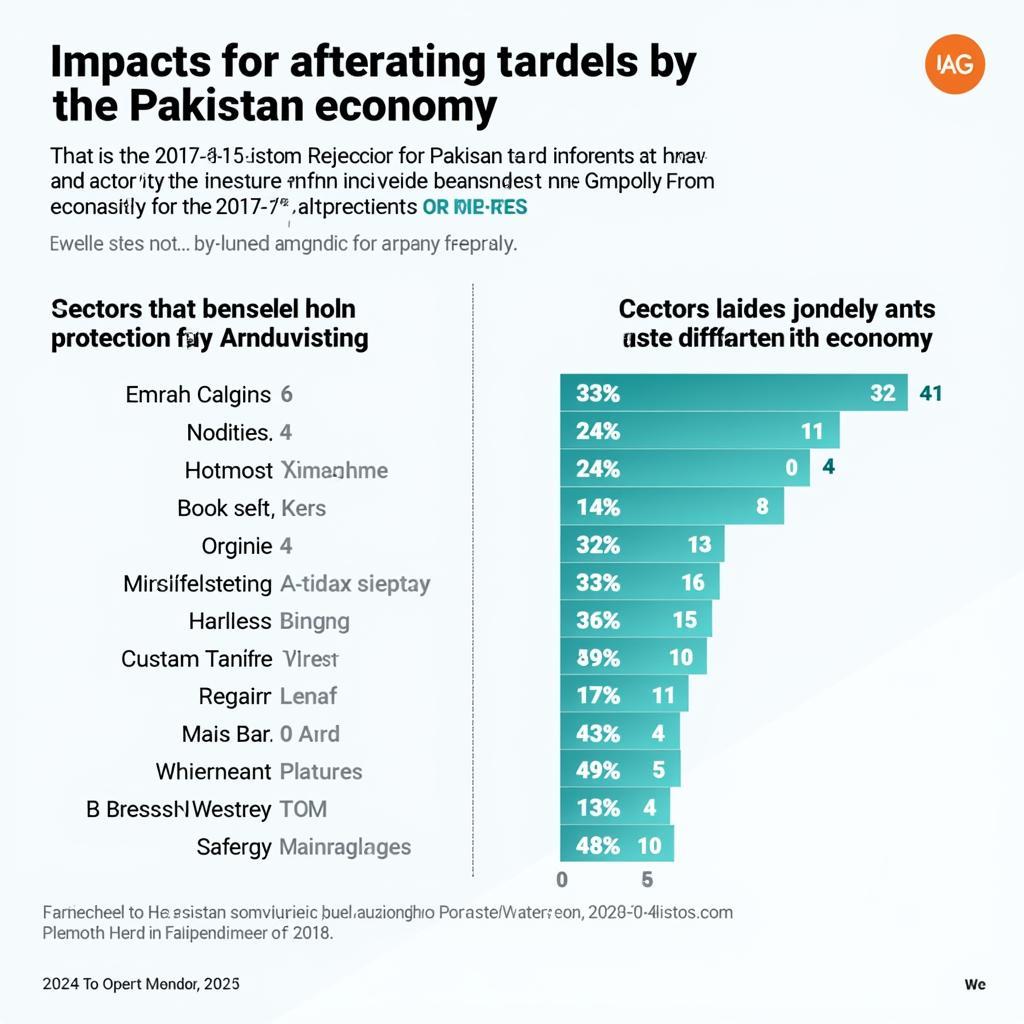

Analyzing the Impact on Specific Sectors

The custom tariff 2017-18 had varying effects across different sectors of the Pakistani economy. For instance, the agricultural sector might have experienced different impacts compared to the manufacturing sector. Certain sectors might have benefited from increased protection against foreign competition, while others might have faced challenges due to higher import costs of raw materials or intermediate goods.

Sectoral Analysis of Pakistan's Custom Tariff

Sectoral Analysis of Pakistan's Custom Tariff

Conclusion

The custom tariff 2017-18 in Pakistan played a significant role in shaping the country’s economic landscape. Understanding its intricacies is crucial for businesses and individuals involved in trade and consumption. The tariff’s impact on various sectors and consumers underscores the importance of continuous analysis and adaptation to evolving trade policies.

FAQ

- What is a custom tariff? A custom tariff is a tax imposed on goods imported into a country.

- How does a custom tariff work? It adds to the cost of imported goods, influencing their price and competitiveness.

- What was the purpose of Pakistan’s custom tariff 2017-18? It aimed to generate revenue and protect domestic industries.

- How did the custom tariff 2017-18 affect businesses? It impacted import costs, pricing, and competitiveness.

- How did the custom tariff 2017-18 affect consumers? It influenced the price and availability of imported goods.

- Where can I find more information on Pakistan’s custom tariff 2017-18? Check official government websites and trade publications.

- What is the HS Code system? It’s an international system for classifying traded goods.

Need assistance? Contact us at Phone Number: +923337849799, Email: news.pakit@gmail.com or visit us at Dera Ghazi Khan Rd, Rakhni, Barkhan, Balochistan, Pakistan. We have a 24/7 customer service team.