Gift Deed In Pakistan is a legal instrument used to transfer ownership of property from one person (the donor) to another (the donee) without any exchange of money or other consideration. This voluntary transfer is governed by specific legal provisions and requires careful execution to be legally valid. Understanding the intricacies of a gift deed is crucial for both donors and donees to ensure a smooth and legally sound transfer of property.

What is a Gift Deed in Pakistan?

A gift deed, in essence, formalizes the act of gifting immovable property, such as land, houses, or apartments. It serves as conclusive proof of the transfer and safeguards the rights of both parties involved. The Registration Act 1908 Pakistan dictates the legal framework surrounding the registration and execution of gift deeds. It’s a critical document that distinguishes a gift from a sale or other forms of property transfer.

Legal Requirements for a Valid Gift Deed in Pakistan

Several key elements must be present for a gift deed to be considered legally valid in Pakistan. Firstly, the donor must be of sound mind and legally competent to make the gift. Secondly, the gift must be made voluntarily, without any coercion or undue influence. Thirdly, the donee must accept the gift during the donor’s lifetime. Finally, the gift deed must be properly registered with the relevant sub-registrar’s office. Failing to meet these requirements can lead to legal challenges and disputes in the future.

Importance of Registration

Registration of the gift deed is paramount. It establishes legal ownership and protects the donee’s rights. The registration process involves submitting the deed, along with necessary documents, to the sub-registrar’s office within the jurisdiction where the property is located. This legal formality offers security and prevents future complications.

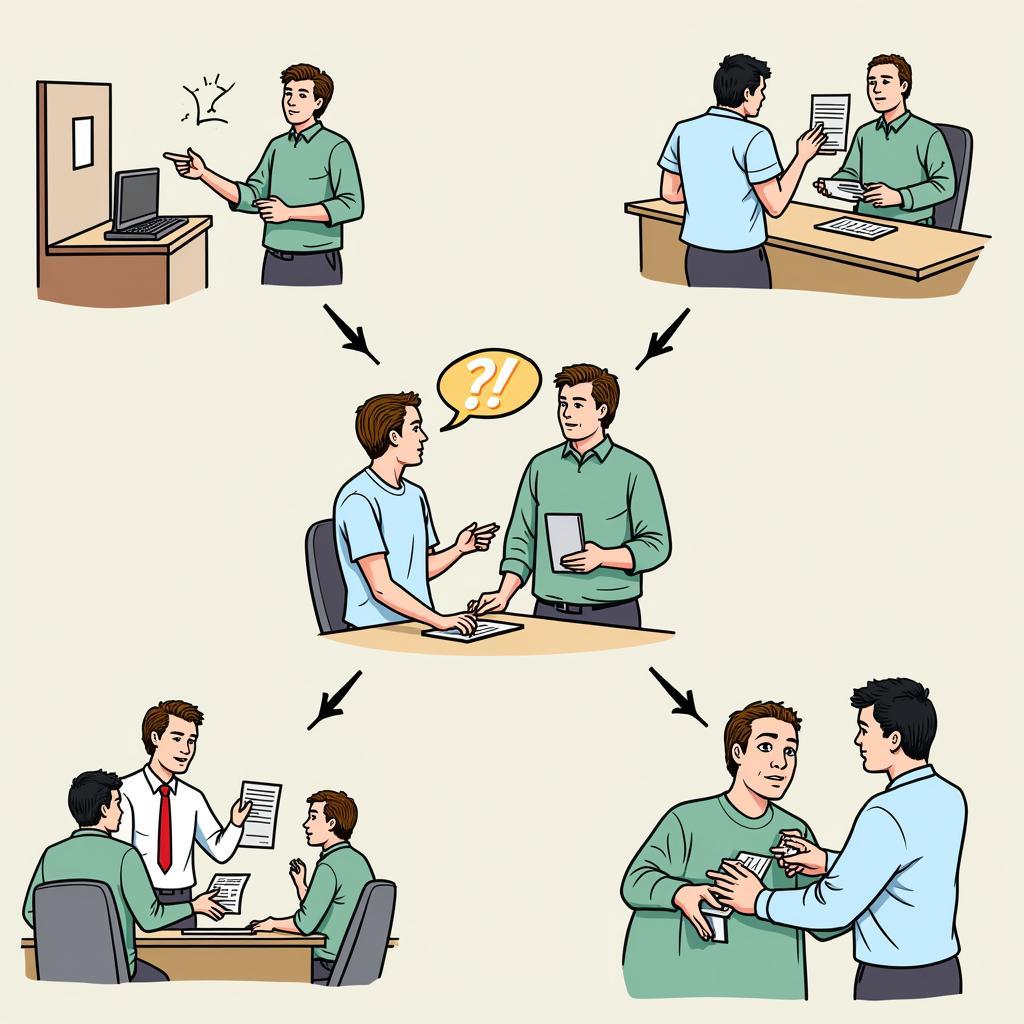

Gift Deed Registration Process

Gift Deed Registration Process

Key Components of a Gift Deed

A gift deed in Pakistan typically includes several key components. It specifies the details of the donor and the donee, provides a precise description of the gifted property, clearly states the intention of gifting, and confirms the acceptance of the gift by the donee. Witnesses are also required to attest to the execution of the deed, adding another layer of legal validity.

Understanding the Gift Deed Format

Understanding the specific gift deed format pakistan is essential. While seeking legal counsel is always recommended, a basic understanding of the format can help individuals navigate the process more confidently. The format outlines the necessary sections and ensures all legal requirements are met.

“A well-drafted gift deed is essential for a smooth transfer of property,” says Barrister Ayesha Khan, a prominent lawyer specializing in property law in Lahore. “It’s crucial to ensure all legal requirements are met to avoid future disputes.”

Tax Implications of Gift Deeds in Pakistan

Gift deeds can have tax implications, depending on the relationship between the donor and the donee. While gifts between close family members may be exempt from certain taxes, gifts to non-family members might be subject to different tax regulations. Understanding these implications is vital for financial planning.

Common Misconceptions about Gift Deeds

Several misconceptions often surround gift deeds. One common myth is that a gift deed can be revoked at any time. However, once a gift deed is registered, it is generally irrevocable. Another misconception is that gift deeds are only used for transferring property to family members. In reality, a gift deed can be used to transfer property to anyone, regardless of their relationship with the donor.

“Many people believe they can easily revoke a gift deed. This isn’t true,” advises Mr. Imran Malik, a senior property consultant in Karachi. “A registered gift deed provides permanent ownership to the donee.”

Conclusion

A gift deed in Pakistan serves as a vital legal document for transferring property ownership as a gift. Understanding the legal requirements, key components, and potential tax implications is crucial for both donors and donees. Seeking professional legal advice is always recommended to ensure a seamless and legally sound transfer of property. By understanding the process thoroughly, individuals can navigate the intricacies of gift deeds effectively. Remember, a correctly executed gift deed in Pakistan ensures a smooth and legally secure transfer of property.

FAQ

- What is the difference between a gift deed and a sale deed?

- Can a gift deed be challenged in court?

- What documents are required for registering a gift deed?

- Can a gift deed be made for movable property?

- What happens if the donor passes away before the gift deed is registered?

- Can a gift deed be used to avoid inheritance tax?

- What are the tax implications for the donee?

For further support, please contact us: Phone: +923337849799, Email: news.pakit@gmail.com or visit our office at Dera Ghazi Khan Rd, Rakhni, Barkhan, Balochistan, Pakistan. We have a 24/7 customer support team.