GPF, or General Provident Fund, is a crucial savings scheme for government employees in Pakistan. It acts as a financial safety net, providing a lump-sum amount upon retirement, resignation, or in unfortunate circumstances, to the employee’s family. Understanding the intricacies of GPF rules is essential for all government employees to maximize their benefits and plan their financial future. This article provides a comprehensive guide to GPF rules in Pakistan, covering everything from eligibility and contributions to withdrawals and advances.

Eligibility and Contributions: Who Can Benefit from GPF in Pakistan?

All permanent government employees in Pakistan are eligible for the GPF scheme. Temporary employees may also be eligible under specific conditions. A key aspect of GPF is the contribution, which is a fixed percentage of the employee’s basic salary deducted monthly. The government also contributes a certain amount, further enhancing the fund’s growth. Understanding these contribution rates is crucial for accurate financial planning. While the employee’s contribution is mandatory, it’s a valuable investment towards a secure future.

How are GPF Contributions Calculated?

GPF contributions are calculated based on a predetermined percentage of the employee’s basic salary. This percentage can vary and is subject to government regulations. It’s important to stay updated on the current rates to ensure accurate deductions and maximum benefit accumulation.

GPF Withdrawals and Advances: Accessing Your Funds

While the primary purpose of GPF is to provide a lump sum upon retirement, there are provisions for withdrawals and advances under specific circumstances. Understanding these rules is vital for navigating unforeseen financial needs. Withdrawals are typically allowed for specific purposes such as marriage, education, or purchasing a house. Advances can be taken against the accumulated balance for emergencies.

What are the Eligible Reasons for GPF Withdrawals?

GPF withdrawals are permitted for specific life events, including marriage, higher education expenses for children, and purchasing or constructing a house. The required documentation and procedures for each situation are clearly defined within the GPF rules. Understanding these requirements streamlines the withdrawal process.

GPF and Retirement: Planning for Your Future

GPF plays a critical role in retirement planning for government employees in Pakistan. The accumulated balance, along with the accrued interest, provides a significant financial cushion, enabling a comfortable transition into retirement. Knowing how to calculate your estimated GPF balance at retirement is crucial for effective financial planning.

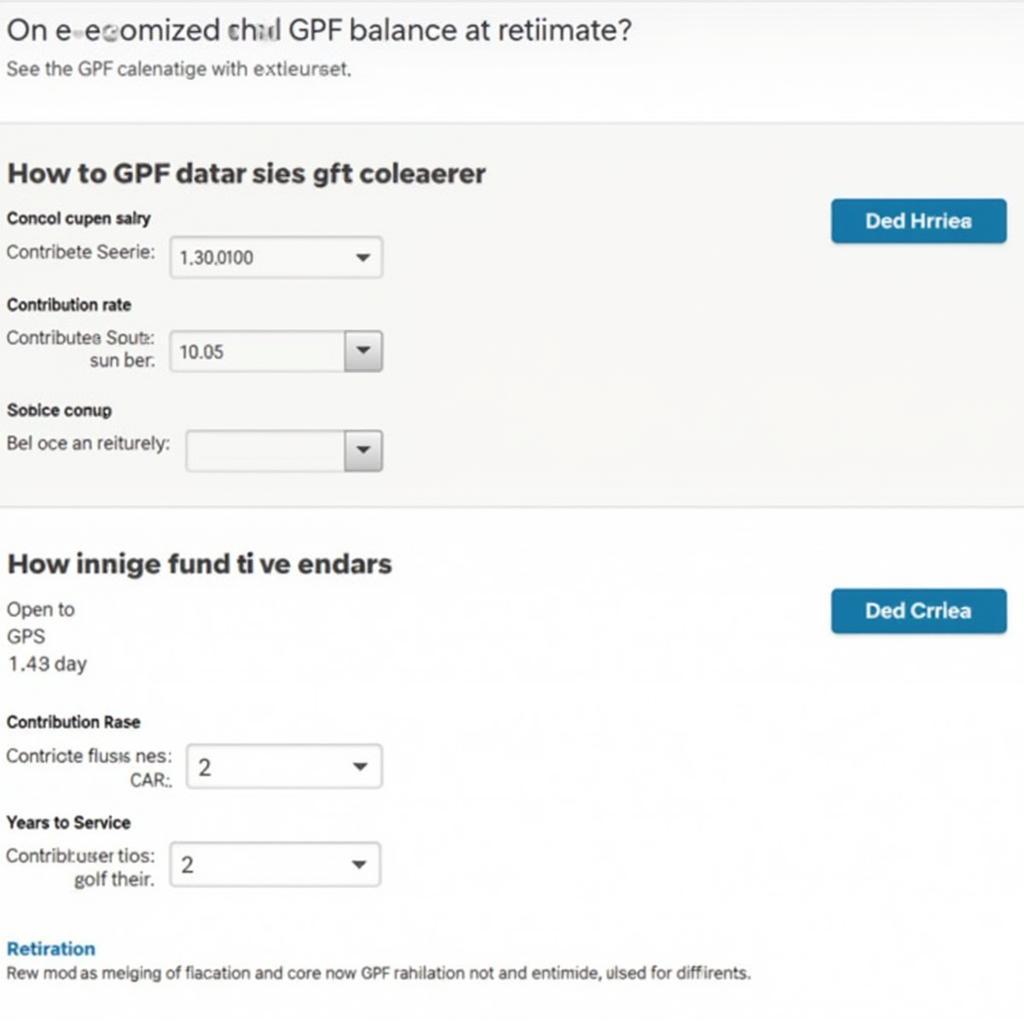

How Can I Calculate My Estimated GPF Balance at Retirement?

Calculating your estimated GPF balance at retirement involves considering factors like your current contribution rate, the government’s contribution, the projected interest rate, and your remaining years of service. Utilizing online GPF calculators or consulting with financial advisors can provide a more accurate projection.

GPF Retirement Calculator in Pakistan

GPF Retirement Calculator in Pakistan

Conclusion: Maximizing Your GPF Benefits

Understanding and navigating the GPF rules in Pakistan is essential for every government employee. From understanding the contribution structure and withdrawal procedures to planning for retirement, a thorough knowledge of GPF empowers employees to make informed financial decisions and secure their future. By actively managing your GPF account and staying updated on the latest regulations, you can maximize your benefits and ensure a financially secure future.

FAQ

- What is the current GPF contribution rate in Pakistan?

- Can I withdraw my entire GPF balance before retirement?

- What are the documents required for a GPF advance?

- How is the interest rate on GPF calculated?

- What happens to my GPF account if I resign from government service?

- Can I nominate multiple beneficiaries for my GPF account?

- How can I access my GPF account statement online?

Common GPF Scenarios:

- Scenario 1: An employee needs funds for their child’s higher education. They can apply for a GPF withdrawal, providing necessary documentation like admission letters and fee receipts.

- Scenario 2: An employee is nearing retirement and wants to estimate their final GPF balance. They can use online calculators or consult with financial advisors.

- Scenario 3: An employee faces a medical emergency and requires immediate funds. They can apply for a GPF advance, subject to the prescribed rules and limitations.

Further Reading and Resources:

For more detailed information and official updates on GPF rules in Pakistan, you can explore the official government websites and publications related to the GPF scheme.

Need help with your GPF? Contact us! Phone: +923337849799, Email: news.pakit@gmail.com or visit our office at Dera Ghazi Khan Rd, Rakhni, Barkhan, Balochistan, Pakistan. Our customer service team is available 24/7.