Mobile Insurance In Pakistan is becoming increasingly important as smartphone penetration rises and device costs escalate. Protecting your valuable device from theft, damage, and other unforeseen events is now a crucial consideration for many Pakistanis. This guide explores everything you need to know about mobile insurance in Pakistan, from understanding its benefits to navigating the claim process.

Understanding the Need for Mobile Insurance in Pakistan

The Pakistani mobile phone market is booming. With a diverse range of devices available, from budget-friendly options to high-end flagships, mobile phones have become integral to daily life. However, this increased reliance on mobile technology brings with it the risk of loss or damage. Mobile insurance offers a safety net, protecting your investment and providing peace of mind. From accidental damage to theft, a good insurance policy can cover a range of scenarios. Thinking about getting a caravan? Check out caravan for sale in Pakistan.

Types of Mobile Insurance Coverage in Pakistan

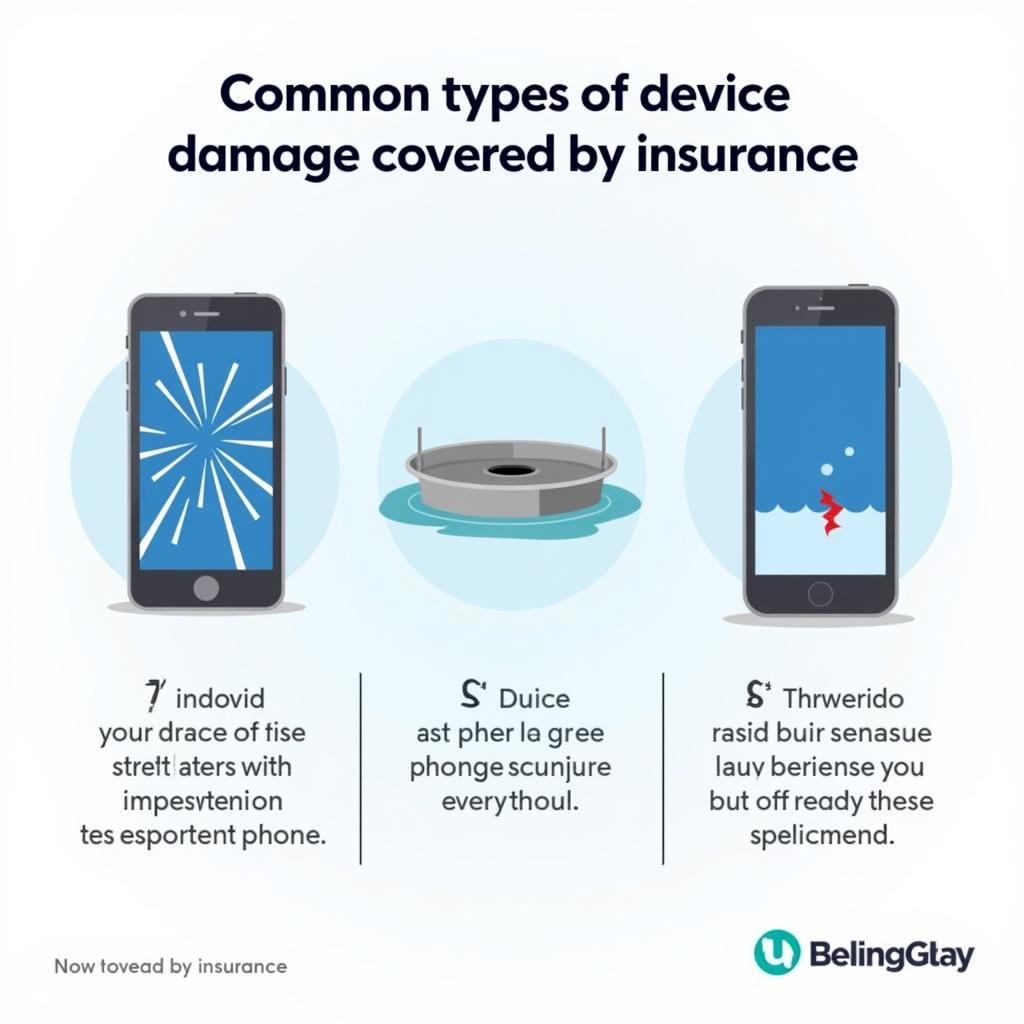

Device Protection

Types of mobile device protection available in Pakistan

Types of mobile device protection available in Pakistan

Device protection plans typically cover accidental damage such as cracked screens, liquid damage, and mechanical failures. Some policies also cover theft and loss, though these often come with higher premiums. Understanding the specifics of your coverage is crucial. Be sure to check what is and isn’t covered before committing to a policy. Do you know the price of a double cabin in Pakistan?

Extended Warranty

Some manufacturers offer extended warranty options that cover manufacturing defects beyond the standard warranty period. While not strictly insurance, these warranties can provide added protection for specific issues related to the device’s hardware or software. If you’re considering a used Audi, see Audi A5 for sale in Pakistan.

How to Choose the Right Mobile Insurance Plan in Pakistan

Choosing the right mobile insurance plan depends on your individual needs and budget. Consider the value of your device, your usage habits, and the potential risks you face.

- Assess Your Needs: Do you frequently travel or work in high-risk environments? Are you prone to dropping your phone? Honest self-assessment can help you identify the type of coverage you need.

- Compare Policies: Research different insurance providers and compare their coverage options, premiums, and claim processes.

- Read the Fine Print: Thoroughly review the terms and conditions of any policy before signing up. Pay attention to exclusions, deductibles, and claim limits.

Making a Claim on Your Mobile Insurance in Pakistan

The claim process varies depending on the insurance provider. Generally, you will need to provide proof of purchase, details of the incident, and any supporting documentation such as police reports in case of theft. Consider car modifications in Pakistan to personalize your vehicle.

- Report Promptly: Report the incident to your insurance provider as soon as possible. Delays can complicate the claim process.

- Provide Accurate Information: Ensure all the information you provide is accurate and complete.

- Follow Instructions: Carefully follow the instructions provided by your insurance provider.

Looking for an affordable car? Check out the Hyundai i10 price in Pakistan.

Conclusion: Protecting Your Investment with Mobile Insurance in Pakistan

Mobile insurance in Pakistan is a smart investment for anyone who relies heavily on their smartphone. With the rising costs of mobile devices, protecting yourself against unforeseen circumstances is more important than ever. By understanding the different types of coverage available and choosing the right plan for your needs, you can ensure your device is protected and enjoy peace of mind. Mobile insurance in Pakistan gives you the security you need in today’s connected world.

FAQ

- What does mobile insurance typically cover?

- How much does mobile insurance cost in Pakistan?

- What is the claim process for mobile insurance?

- Are there different tiers of mobile insurance coverage?

- Can I insure a second-hand phone in Pakistan?

- What documents do I need to make a claim?

- How long does it take to process a mobile insurance claim?

Mr. Hassan Khan, a leading tech analyst in Lahore, states, “With the increasing dependence on smartphones, mobile insurance is no longer a luxury, but a necessity in Pakistan.” Another expert, Ms. Ayesha Malik, a telecommunications consultant in Karachi, adds, “Choosing the right mobile insurance plan can save you significant financial stress in the long run.” Finally, Mr. Imran Ali, a mobile phone retailer in Islamabad, emphasizes, “Don’t underestimate the risk of theft or damage. Mobile insurance provides valuable peace of mind.”

For further assistance regarding Mobile Insurance in Pakistan, please contact us at: Phone Number: +923337849799, Email: news.pakit@gmail.com Or visit our office at: Dera Ghazi Khan Rd, Rakhni, Barkhan, Balochistan, Pakistan. We have a 24/7 customer support team.