Ponzi schemes in Pakistan, like elsewhere, prey on the desire for quick riches, often leaving victims devastated. These fraudulent investment operations promise high returns with little to no risk, luring unsuspecting individuals into a trap of deceit. Understanding how these schemes operate is crucial to protecting yourself and your finances.

How Ponzi Schemes Work in Pakistan

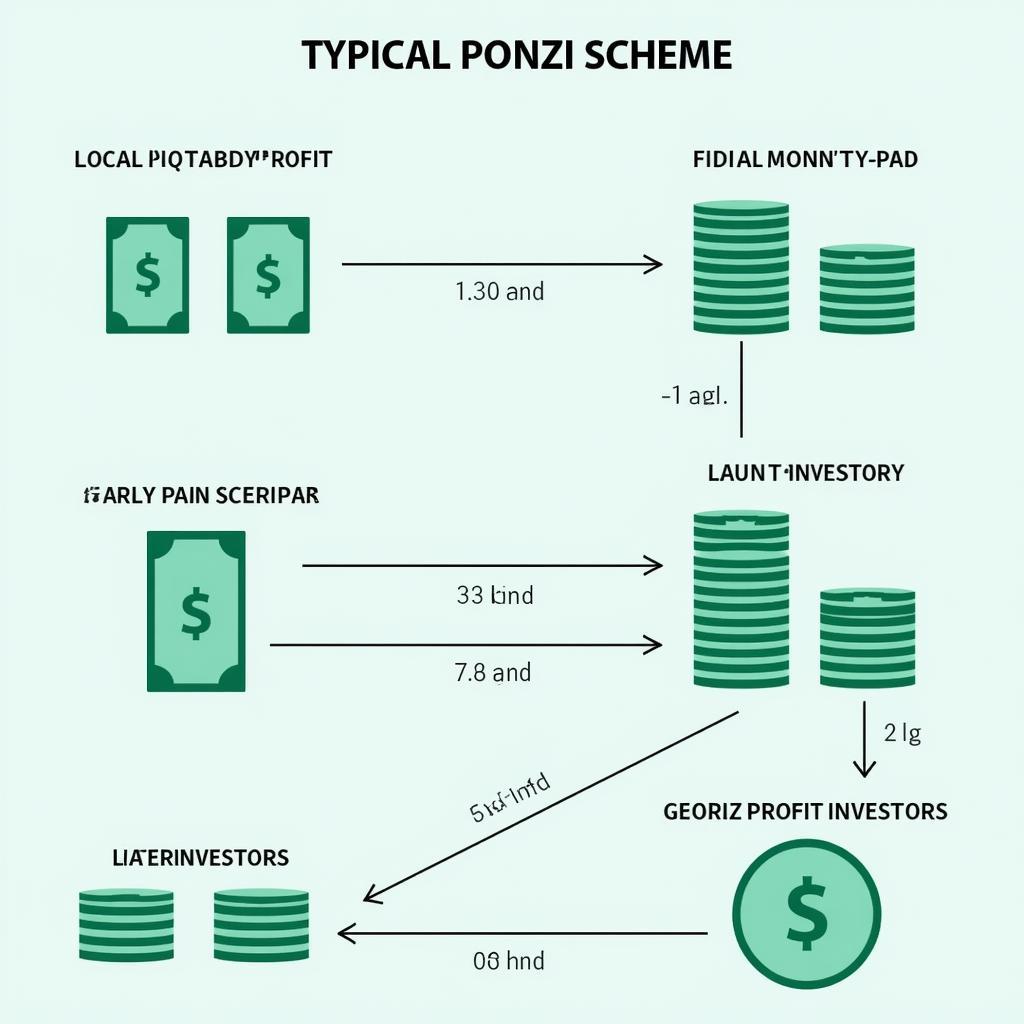

Ponzi schemes operate on a simple yet deceptive principle: paying early investors with funds from new investors. No legitimate underlying business or investment generates the promised profits. Instead, the scheme relies solely on the continuous influx of new capital. This creates an illusion of success, attracting even more investors. However, the scheme is inherently unsustainable. Eventually, the flow of new investors dries up, leaving the majority of participants with significant financial losses.

In Pakistan, these schemes often exploit cultural nuances and close-knit communities, leveraging trust and social connections to spread their web of deception. They may target specific demographics, promising investments tailored to their needs, further enhancing the illusion of legitimacy.

Ponzi Scheme Diagram

Ponzi Scheme Diagram

Identifying Red Flags of a Ponzi Scheme in Pakistan

Recognizing the warning signs of a Ponzi scheme is paramount to avoiding becoming a victim. While these schemes can be sophisticated, several common red flags can help you identify potential fraud. Look out for unusually high and consistent returns. No legitimate investment can guarantee such consistent profits. Be wary of complex or secretive investment strategies. If you don’t understand how the investment works, it’s best to steer clear. Another telltale sign is difficulty withdrawing your money. Legitimate investments allow you access to your funds.

Furthermore, high-pressure sales tactics, emphasizing exclusivity and limited-time offers, should raise suspicion. Ponzi scheme operators often create a sense of urgency to pressure potential investors into making quick decisions without proper due diligence. Always verify the registration and licensing of the investment company with relevant authorities like the Securities and Exchange Commission of Pakistan (SECP).

Protecting Yourself from Ponzi Schemes in Pakistan

Protecting yourself from Ponzi schemes requires vigilance and a healthy dose of skepticism. Thoroughly research any investment opportunity before committing your funds. Verify the company’s registration, check online reviews, and consult with an independent financial advisor. Don’t be swayed by testimonials or endorsements, as these can be easily fabricated. Understand the risks involved and ensure you are comfortable with the potential for loss.

Diversifying your investments across different asset classes is a sound financial strategy that can also mitigate the impact of a potential Ponzi scheme. By spreading your investments, you limit your exposure to any single investment vehicle.

What to Do if You Suspect a Ponzi Scheme

If you suspect you have encountered a Ponzi scheme, report it immediately to the SECP and other relevant law enforcement agencies. Gather all documentation related to the investment, including contracts, emails, and bank statements. This information will be crucial in any investigation. Cooperate fully with authorities and seek legal counsel if necessary.

Reporting a Ponzi Scheme

Reporting a Ponzi Scheme

Conclusion

Ponzi schemes in Pakistan continue to pose a significant threat to investors. By understanding how these schemes operate, recognizing the red flags, and taking proactive steps to protect yourself, you can significantly reduce your risk of becoming a victim. Remember, if an investment opportunity sounds too good to be true, it probably is.

FAQs

-

What is the most common type of Ponzi Scheme In Pakistan?

Schemes promising high returns from real estate, foreign exchange trading, and cryptocurrency are prevalent. -

How can I verify the legitimacy of an investment company in Pakistan?

Check the SECP’s website for registered companies and consult with a licensed financial advisor. -

What are the penalties for operating a Ponzi scheme in Pakistan?

Penalties can include significant fines and imprisonment. -

What are some recent examples of Ponzi schemes in Pakistan? (Avoid naming specific companies, focus on general trends)

Recent trends include schemes using online platforms and social media to attract investors. -

Who should I contact if I suspect a Ponzi scheme?

Contact the SECP and local law enforcement authorities.

Situations with Common Questions:

-

Scenario: You are approached by a friend with an “amazing” investment opportunity.

-

Question: How do I politely decline without damaging the friendship? Express gratitude for the offer, but explain you’re not currently looking for new investments.

-

Scenario: You’ve invested a small amount in a suspected Ponzi scheme.

-

Question: Should I invest more to recoup potential losses? Absolutely not. Further investment will likely only increase your losses.

-

Scenario: You’re unsure if an investment is legitimate.

-

Question: Who can I consult for a second opinion? A licensed financial advisor can provide an independent assessment.

Further Reading

Explore our other articles on investment scams and financial literacy on the Pakistan News website.

Need assistance? Contact us at Phone: +923337849799, Email: [email protected] or visit our office at Dera Ghazi Khan Rd, Rakhni, Barkhan, Balochistan, Pakistan. Our customer service team is available 24/7.