Rhodium, a precious metal even rarer than platinum, commands a high price globally, and Pakistan is no exception. Understanding the factors influencing Rhodium Price In Pakistan requires a deep dive into the global market, local economic conditions, and specific applications of this precious metal.

Factors Affecting Rhodium Price in Pakistan

The rhodium price in Pakistan, like anywhere else, is primarily driven by global supply and demand. South Africa accounts for the vast majority of global rhodium production. Any disruption in supply, such as mining strikes or political instability, can significantly impact the price.  Rhodium Mining in South Africa Demand for rhodium is largely tied to the automotive industry, where it is used in catalytic converters to reduce harmful emissions. Increased automobile production, especially in emerging markets, can drive up rhodium demand and, consequently, the price.

Rhodium Mining in South Africa Demand for rhodium is largely tied to the automotive industry, where it is used in catalytic converters to reduce harmful emissions. Increased automobile production, especially in emerging markets, can drive up rhodium demand and, consequently, the price.

Local Market Dynamics and Rhodium Price

While the international market plays a crucial role, local factors also influence the rhodium price in Pakistan. The exchange rate between the Pakistani Rupee and the US dollar, the primary currency for trading rhodium, directly affects the local price. A weaker Rupee often translates to a higher rhodium price in Pakistan. Import duties and taxes imposed by the Pakistani government also contribute to the final cost. Furthermore, local demand from industries like jewelry and electronics can impact the rhodium price in Pakistan, although to a lesser extent than the automotive sector.

Understanding Rhodium Applications and Their Impact on Price

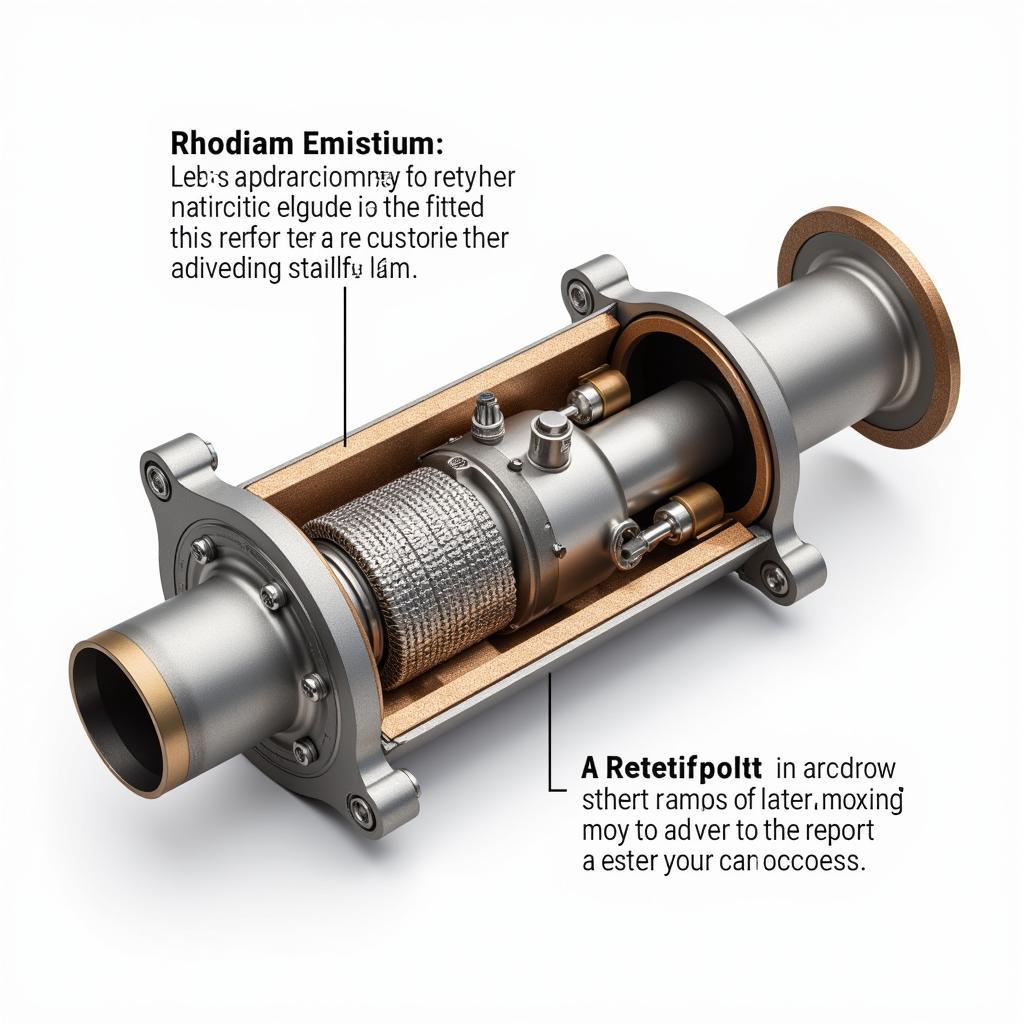

Rhodium’s primary use in catalytic converters is a key driver of its price. Stringent emission regulations worldwide compel automakers to incorporate rhodium in their vehicles, creating a consistent demand.  Rhodium Catalytic Converter Beyond automotive applications, rhodium is also used in jewelry, electrical contacts, and certain industrial processes. While these applications contribute to overall demand, the automotive sector remains the dominant force impacting the rhodium price. For example, a surge in demand for electric vehicles, which also require catalytic converters, can further elevate rhodium prices.

Rhodium Catalytic Converter Beyond automotive applications, rhodium is also used in jewelry, electrical contacts, and certain industrial processes. While these applications contribute to overall demand, the automotive sector remains the dominant force impacting the rhodium price. For example, a surge in demand for electric vehicles, which also require catalytic converters, can further elevate rhodium prices.

Investing in Rhodium in Pakistan

Investing in rhodium can be a complex undertaking. Investors can consider options like purchasing rhodium bars or coins, or investing in rhodium-backed Exchange Traded Funds (ETFs). However, due to its volatility, rhodium is often considered a high-risk investment. It’s crucial to thoroughly research the market and understand the risks before investing in rhodium. You might also consider the palladium ring price in Pakistan as an alternative investment.

Future Trends and Predictions for Rhodium Price

Predicting the future price of rhodium is challenging due to market volatility. Factors like technological advancements, evolving emission standards, and the global economic landscape all play a role. Some analysts predict increased demand for rhodium as countries implement stricter environmental regulations. However, the development of alternative catalytic converter technologies could potentially reduce rhodium demand in the long run.

Expert Insights on Rhodium Market

Asim Khan, a leading commodities analyst at Karachi Stock Exchange, notes, “Rhodium’s price trajectory is closely tied to the automotive industry’s future. While the transition to electric vehicles may eventually impact demand, current trends suggest continued strong demand for rhodium in the foreseeable future.”  Rhodium Price Chart Another expert, Fatima Ali, a senior researcher at the Lahore University of Management Sciences, adds, “The supply side constraints and geopolitical factors affecting rhodium production in South Africa add another layer of complexity to forecasting its price.” Understanding these complexities is crucial for navigating the rhodium market. You may want to compare this with the white gold rate in pakistan.

Rhodium Price Chart Another expert, Fatima Ali, a senior researcher at the Lahore University of Management Sciences, adds, “The supply side constraints and geopolitical factors affecting rhodium production in South Africa add another layer of complexity to forecasting its price.” Understanding these complexities is crucial for navigating the rhodium market. You may want to compare this with the white gold rate in pakistan.

Conclusion

The rhodium price in Pakistan is a complex interplay of global market forces, local economic conditions, and specific industry demands. While the automotive sector remains the primary driver of rhodium price, other factors like exchange rates and government regulations also contribute. Staying informed about market trends and understanding the various applications of rhodium is crucial for anyone interested in this valuable metal. For those interested in other precious metals, you can check out the white gold ring price in pakistan.

FAQ

- What is the current rhodium price in Pakistan? (The price fluctuates daily; check reputable sources for the latest information.)

- Where can I buy rhodium in Pakistan? (Consult with reputable precious metal dealers and financial institutions.)

- Is rhodium a good investment? (Rhodium is a volatile investment; professional advice is recommended.)

- What are the industrial uses of rhodium? (Primarily catalytic converters, but also in jewelry, electronics, and other industrial applications.)

- How does the global rhodium market affect the price in Pakistan? (Global supply and demand significantly influence the local price, coupled with exchange rates and import duties.)

- What are the alternatives to rhodium in catalytic converters? (Researchers are exploring alternative materials, but rhodium remains dominant currently.)

- How can I track the rhodium price in Pakistan? (Follow financial news and commodity market reports.)

For further reading on related topics, check out salman khan bracelet price in pakistan and swarovski necklace price in pakistan.

For any assistance or inquiries regarding rhodium price in Pakistan, feel free to contact us. Call us at +923337849799, email us at news.pakit@gmail.com, or visit our office at Dera Ghazi Khan Rd, Rakhni, Barkhan, Balochistan, Pakistan. We have a 24/7 customer support team.