The Roshan Pakistan Scheme aims to attract investment and enhance financial inclusion for non-resident Pakistanis. This initiative offers a range of incentives and benefits, making it easier and more rewarding for overseas Pakistanis to participate in the economic development of their homeland. This article delves into the various aspects of the Roshan Pakistan Scheme, providing valuable insights for potential investors and anyone interested in understanding this significant program.

Understanding the Roshan Pakistan Scheme

Launched to bridge the gap between overseas Pakistanis and their homeland, the Roshan Pakistan Scheme is a comprehensive program that offers a variety of financial products and services tailored specifically for non-resident Pakistanis. The scheme aims to encourage investment in Pakistan, promote financial inclusion, and strengthen ties with the Pakistani diaspora.

Key Features and Benefits

The Roshan Pakistan Scheme comes with several key features and benefits designed to attract non-resident Pakistanis:

- Tax Incentives: Enjoy tax benefits on investments made through the scheme, such as exemption from withholding tax on profits earned.

- Simplified Account Opening: Open Roshan Digital Accounts with ease, requiring minimal documentation and allowing for online account opening from anywhere in the world.

- Investment Opportunities: Explore a diverse range of investment opportunities, including Naya Pakistan Certificates, stock market investments, and real estate options.

- Remittance Facilities: Transfer funds seamlessly and securely to Pakistan through dedicated Roshan Remittance channels, often at preferential exchange rates.

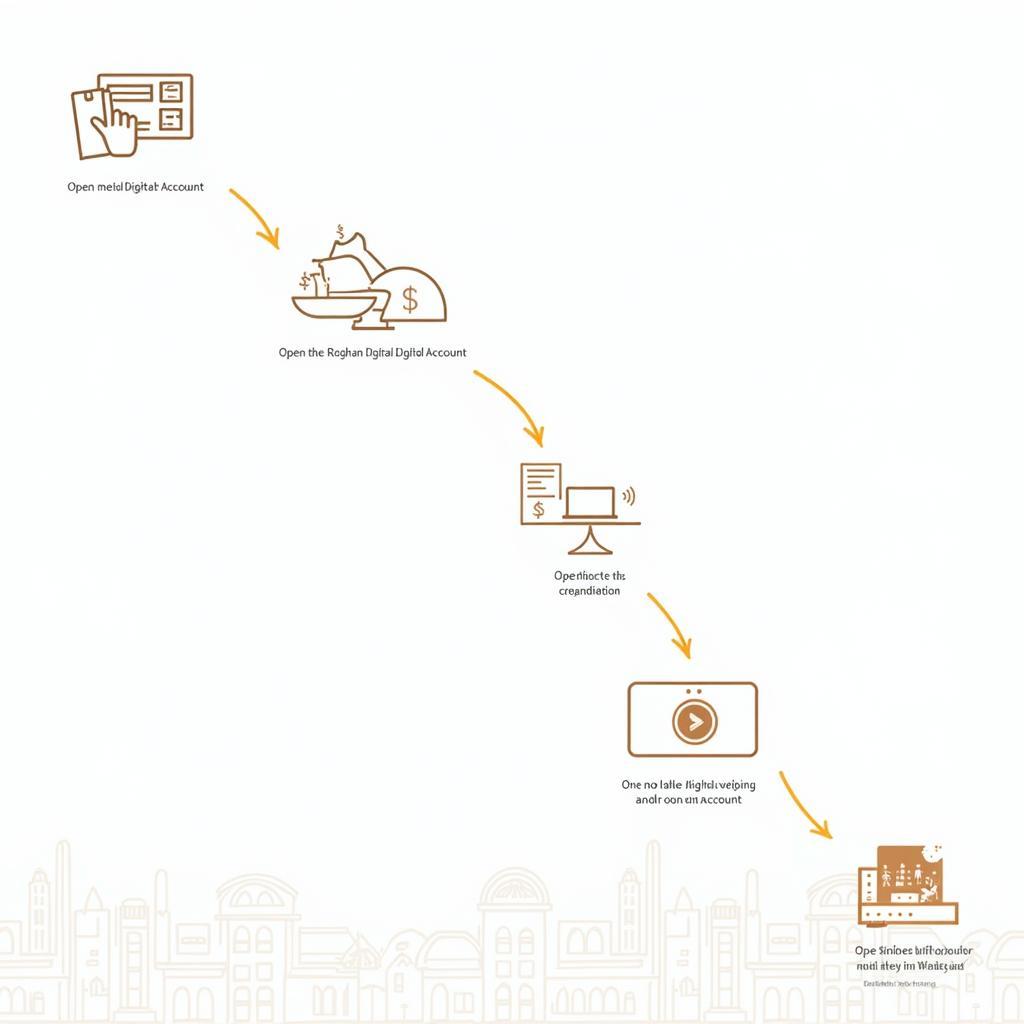

Roshan Pakistan Account Opening Process

Roshan Pakistan Account Opening Process

Eligibility Criteria for the Roshan Pakistan Scheme

To participate in the Roshan Pakistan Scheme, individuals must meet the following eligibility requirements:

- Non-Resident Pakistani: Be a Pakistani citizen residing abroad, holding a valid Pakistani passport or NICOP (National Identity Card for Overseas Pakistanis).

- Source of Funds: Demonstrate a legitimate source of funds for investments made through the scheme.

How to Open a Roshan Digital Account

Opening a Roshan Digital Account is a simple and convenient process, designed to be completed entirely online:

- Choose a Bank: Select from a list of participating banks offering Roshan Digital Accounts.

- Complete the Application Form: Fill out the online application form, providing accurate personal and financial information.

- Submit Documents: Upload scanned copies of required documents, such as your passport, NICOP, and proof of residence.

- Verification Process: Complete a quick and secure online verification process.

Once your application is approved, you will gain access to your Roshan Digital Account, enabling you to start exploring investment opportunities and utilizing the various benefits of the scheme.

Roshan Pakistan Investment Options

Roshan Pakistan Investment Options

Role in Pakistan’s Economic Growth

The Roshan Pakistan Scheme plays a crucial role in driving economic growth in Pakistan:

- Foreign Exchange Inflows: Encourages substantial inflows of foreign exchange, boosting Pakistan’s foreign reserves and strengthening its financial stability.

- Investment Growth: Channels investments into key sectors of the Pakistani economy, supporting job creation and overall economic development.

- Financial Inclusion: Promotes financial inclusion by providing non-resident Pakistanis with access to formal financial services.

Future Outlook and Potential

The Roshan Pakistan Scheme holds immense potential for continued growth and impact:

- Expanding Investment Avenues: Continuous efforts to introduce new and innovative investment products and services tailored to the needs of overseas Pakistanis.

- Technological Advancements: Leveraging technology to further simplify processes, enhance user experience, and make the scheme even more accessible.

- Awareness Campaigns: Ongoing initiatives to raise awareness about the scheme and its benefits among the Pakistani diaspora worldwide.

Conclusion

The Roshan Pakistan Scheme is a commendable initiative that has garnered significant interest from non-resident Pakistanis seeking to connect with their homeland while exploring lucrative investment opportunities. With its attractive features, user-friendly processes, and potential for significant returns, the scheme is well-positioned to continue playing a vital role in Pakistan’s economic growth and development in the years to come.